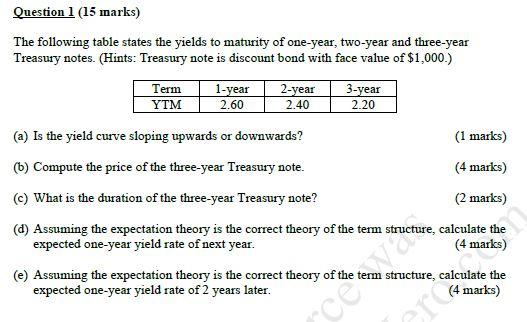

Question: Question 1 (15 marks) The following table states the yields to maturity of one-year, two-year and three-year Treasury notes. (Hints: Treasury note is discount bond

Question 1 (15 marks) The following table states the yields to maturity of one-year, two-year and three-year Treasury notes. (Hints: Treasury note is discount bond with face value of $1,000.) Term 1-year 2-year 3-year YTM 2.60 2.40 2.20 (a) Is the yield curve sloping upwards or downwards? (1 marks) (6) Compute the price of the three-year Treasury note. (4 marks) ) What is the duration of the three-year Treasury note? (2 marks) (d) Assuming the expectation theory is the correct theory of the term structure, calculate the expected one-year yield rate of next year. (4 marks) (e) Assuming the expectation theory is the correct theory of the structure, calculate the expected one-year yield rate of 2 years later. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts