Question: Question 1 (15 pts) Using the information below, prepare the following financial statements for Company ABC's 2020 and 2021, ended December 31, using the

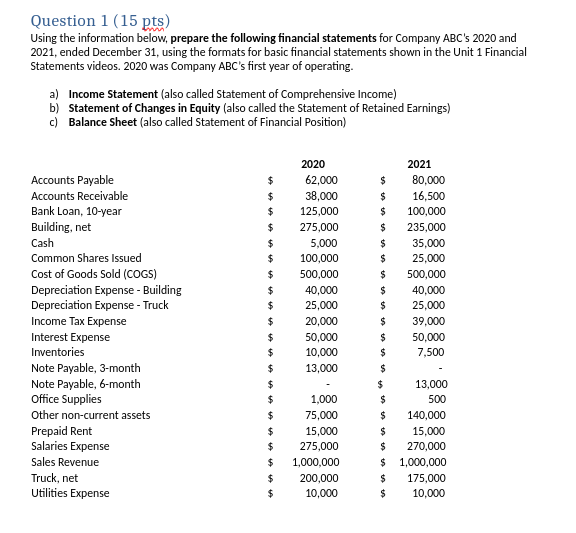

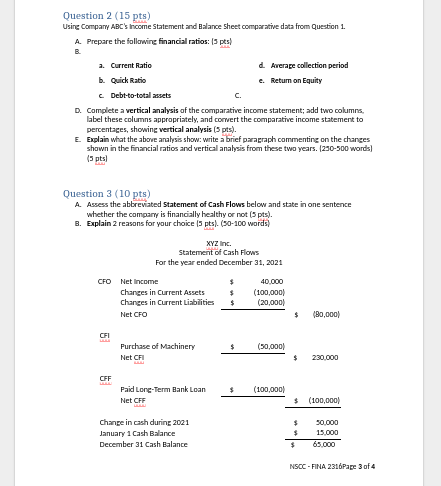

Question 1 (15 pts) Using the information below, prepare the following financial statements for Company ABC's 2020 and 2021, ended December 31, using the formats for basic financial statements shown in the Unit 1 Financial Statements videos. 2020 was Company ABC's first year of operating. a) Income Statement (also called Statement of Comprehensive Income) b) Statement of Changes in Equity (also called the Statement of Retained Earnings) c) Balance Sheet (also called Statement of Financial Position) 2020 2021 Accounts Payable Accounts Receivable Bank Loan, 10-year Building, net Cash $ 62,000 $ 80,000 $ 38,000 $ 16,500 $ 125,000 $ 100,000 $ 275,000 $ 235,000 $ 5,000 $ 35,000 Common Shares Issued $ 100,000 $ 25,000 Cost of Goods Sold (COGS) $ 500,000 $ 500,000 Depreciation Expense - Building $ 40,000 $ 40,000 Depreciation Expense - Truck $ 25,000 $ 25,000 Income Tax Expense $ 20,000 $ 39,000 Interest Expense Inventories $ 50,000 $ 50,000 $ 10,000 $ 7,500 Note Payable, 3-month $ 13,000 $ Note Payable, 6-month $ $ 13,000 Office Supplies $ 1,000 $ 500 Other non-current assets $ 75,000 $ 140,000 Prepaid Rent $ 15,000 $ 15,000 Salaries Expense $ 275,000 $ 270,000 Sales Revenue $ 1,000,000 $ 1,000,000 Truck, net $ 200,000 $ 175,000 Utilities Expense $ 10,000 $ 10,000 Question 2 (15 pts) Using Company ABC's Income Statement and Balance Sheet comparative data from Question 1. A. Prepare the following financial ratios: (5pts) B. a. Current Ratio b. Quick Ratio c Debt-to-total assets d. Average collection period e. Return on Equity C. D. Complete a vertical analysis of the comparative income statement; add two columns, label these columns appropriately, and convert the comparative income statement to percentages, showing vertical analysis (5pts). E. Explain what the above analysis show: write a brief paragraph commenting on the changes shown in the financial ratios and vertical analysis from these two years. (230-500 words) (5pts) Question 3 (10 pts) A. Assess the abbreviated Statement of Cash Flows below and state in one sentence whether the company is financially healthy or not (5pts). B. Explain 2 reasons for your choice (5 pts). (50-100 words) XYZ Inc. Statement of Cash Flows For the year ended December 31, 2021 CFO Net Income $ 40,000 Changes in Current Assets (100,000) Changes in Current Liabilities $ (20,000) Net CFO $ (80,000) CFI Purchase of Machinery Net CFI $ (50,000) $ 230,000 CFF www Paid Long-Term Bank Loan Net CFF $ (100,000) (100,000) wwwwww. Change in cash during 2021 January 1 Cash Balance December 31 Cash Balance $ 50,000 $ 15,000 $ 65,000 NSCC - FINA 2316Page 3 of 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts