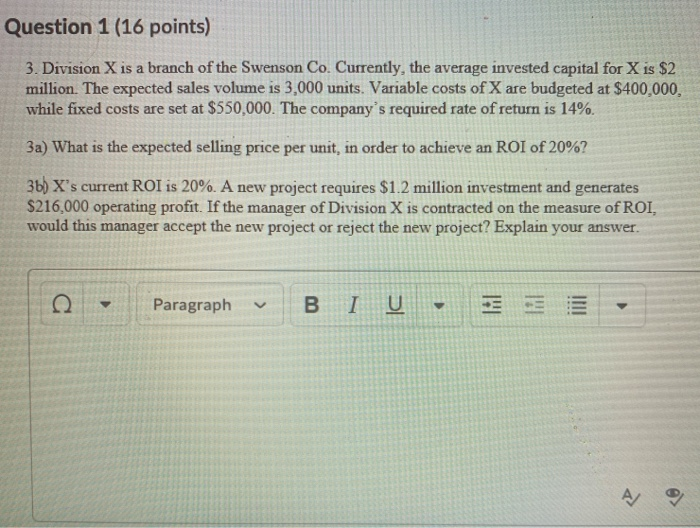

Question: Question 1 (16 points) 3. Division X is a branch of the Swenson Co. Currently, the average invested capital for X is $2 million. The

Question 1 (16 points) 3. Division X is a branch of the Swenson Co. Currently, the average invested capital for X is $2 million. The expected sales volume is 3,000 units. Variable costs of X are budgeted at $400,000 while fixed costs are set at $550,000. The company's required rate of return is 14% 3a) What is the expected selling price per unit, in order to achieve an ROI of 20%? 36) X's current ROI is 20%. A new project requires $1.2 million investment and generates $216,000 operating profit. If the manager of Division X is contracted on the measure of ROI, would this manager accept the new project or reject the new project? Explain your answer. Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts