Question: QUESTION 1 ( 2 0 marks ) a ) Explain in detail the internal rate of return ( IRR ) and net present value (

QUESTION marks

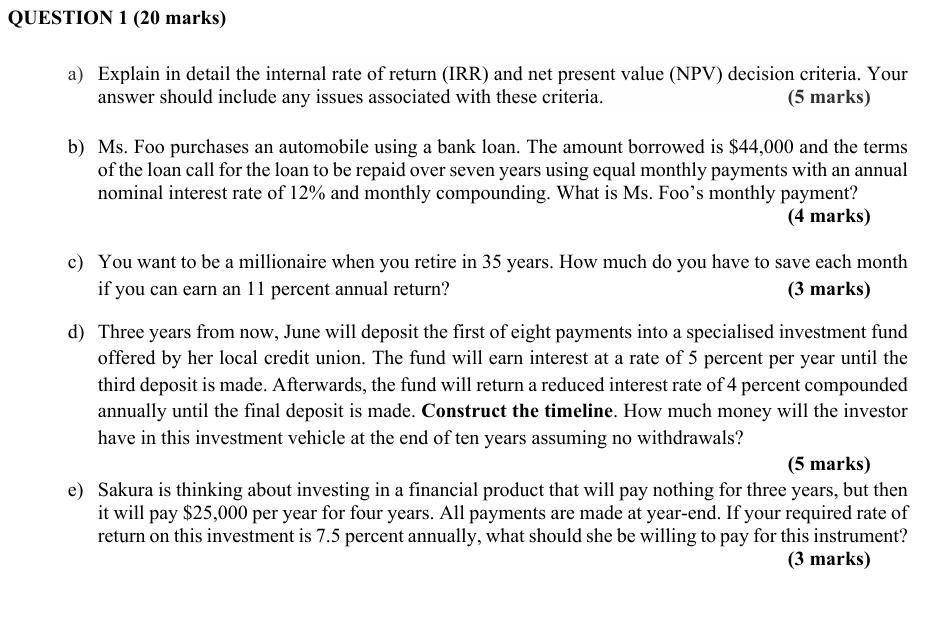

a Explain in detail the internal rate of return IRR and net present value NPV decision criteria. Your

answer should include any issues associated with these criteria.

marks

b Ms Foo purchases an automobile using a bank loan. The amount borrowed is $ and the terms

of the loan call for the loan to be repaid over seven years using equal monthly payments with an annual

nominal interest rate of and monthly compounding. What is Ms Foo's monthly payment?

marks

c You want to be a millionaire when you retire in years. How much do you have to save each month

if you can earn an percent annual return?

marks

d Three years from now, June will deposit the first of eight payments into a specialised investment fund

offered by her local credit union. The fund will earn interest at a rate of percent per year until the

third deposit is made. Afterwards, the fund will return a reduced interest rate of percent compounded

annually until the final deposit is made. Construct the timeline. How much money will the investor

have in this investment vehicle at the end of ten years assuming no withdrawals?

marks

e Sakura is thinking about investing in a financial product that will pay nothing for three years, but then

it will pay $ per year for four years. All payments are made at yearend. If your required rate of

return on this investment is percent annually, what should she be willing to pay for this instrument?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock