Question: Question 1 ( 2 0 points ) : Two used engines are not utilized in an airline's fleet, but instead, are being leased to another

Question points:

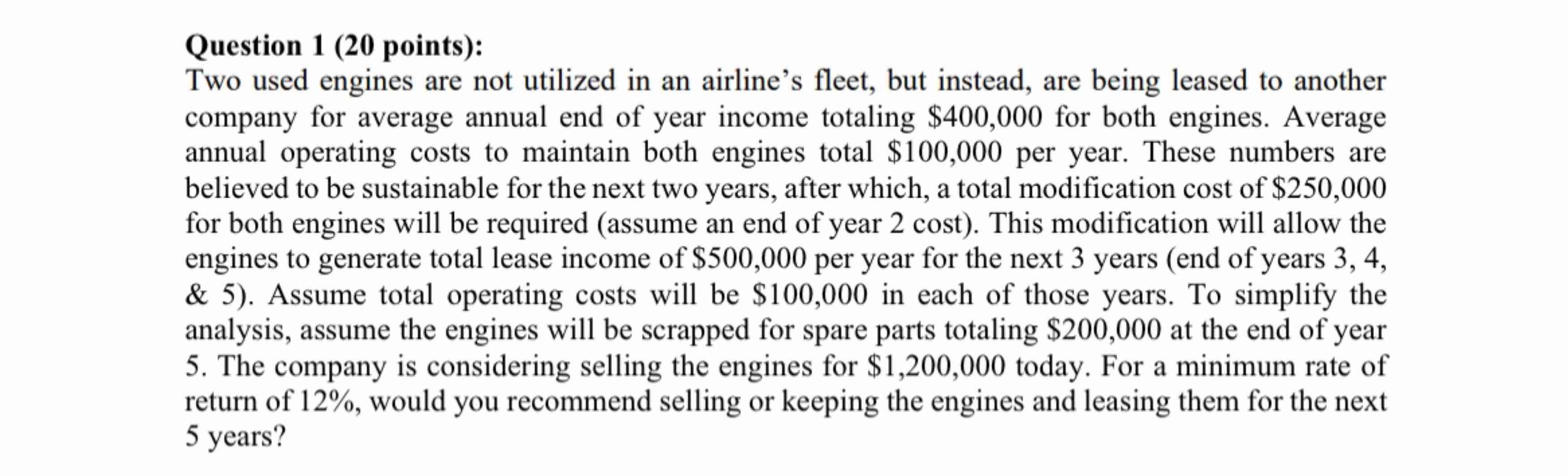

Two used engines are not utilized in an airline's fleet, but instead, are being leased to another company for average annual end of year income totaling $ for both engines. Average annual operating costs to maintain both engines total $ per year. These numbers are believed to be sustainable for the next two years, after which, a total modification cost of $ for both engines will be required assume an end of year cost This modification will allow the engines to generate total lease income of $ per year for the next years end of years & Assume total operating costs will be $ in each of those years. To simplify the analysis, assume the engines will be scrapped for spare parts totaling $ at the end of year The company is considering selling the engines for $ today. For a minimum rate of return of would you recommend selling or keeping the engines and leasing them for the next years?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock