Question: Question 1 2 ( 1 pt ) An analyst is comparing the financial statements of two manufacturing enterprises, Full and Empty. Both enterprises purchased an

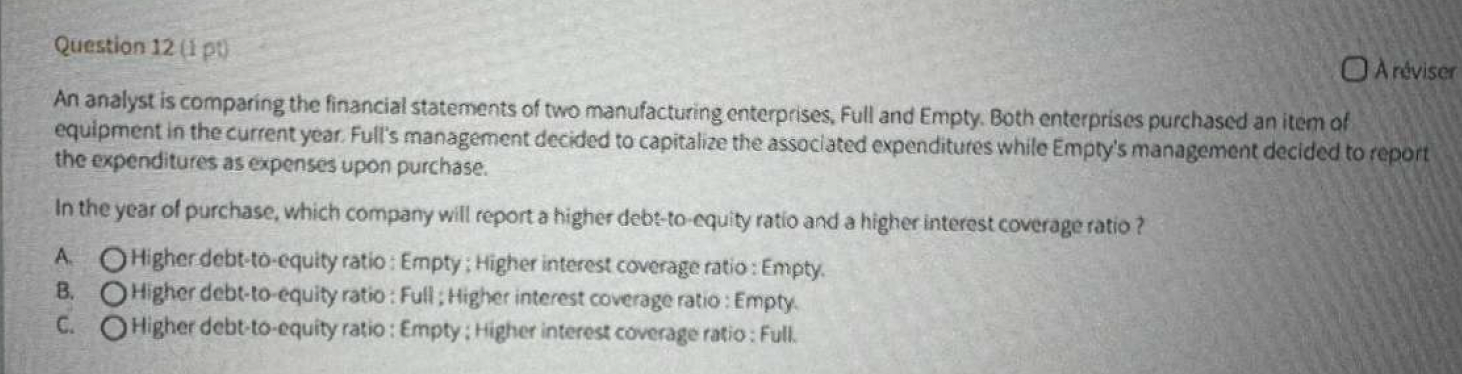

Question pt An analyst is comparing the financial statements of two manufacturing enterprises, Full and Empty. Both enterprises purchased an item of equipment in the current year. Full's management decided to capitalize the assoclated expenditures while Empty's management decided to report the expenditures as expenses upon purchase. In the year of purchase, which company will report a higher debttoequity ratio and a higher interest coverage ratio? A Higher debttoequity ratio : Empty : Higher interest coverage ratio: Empty. B Higher debttoequity ratio : Full: Higher interest coverage ratio : Empty. C Higher debttoequity ratio : Empty ; Higher interest coverage ratio: Full.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock