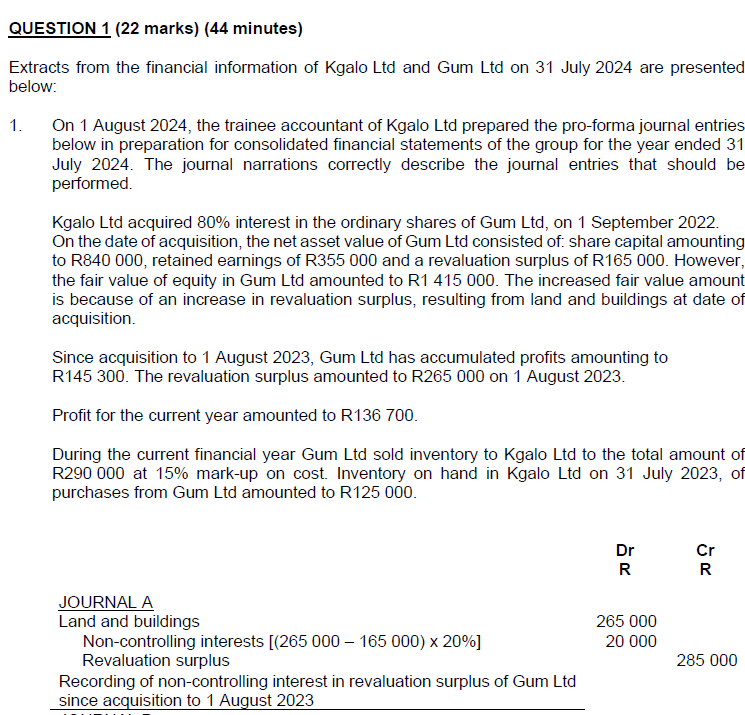

Question: QUESTION 1 ( 2 2 marks ) ( 4 4 minutes ) Extracts from the financial information of Kgalo Ltd and Gum Ltd on 3

QUESTION marks minutes Extracts from the financial information of Kgalo Ltd and Gum Ltd on July are presented below: On August the trainee accountant of Kgalo Ltd prepared the proforma journal entries below in preparation for consolidated financial statements of the group for the year ended July The journal narrations correctly describe the journal entries that should be performed. Kgalo Ltd acquired interest in the ordinary shares of Gum Ltd on September On the date of acquisition, the net asset value of Gum Ltd consisted of: share capital amounting to R retained earnings of R and a revaluation surplus of R However, the fair value of equity in Gum Ltd amounted to R The increased fair value amount is because of an increase in revaluation surplus, resulting from land and buildings at date of acquisition. Since acquisition to August Gum Ltd has accumulated profits amounting to R The revaluation surplus amounted to R on August Profit for the current year amounted to R During the current financial year Gum Ltd sold inventory to Kgalo Ltd to the total amount of R at markup on cost Inventory on hand in Kgalo Ltd on July of purchases from Gum Ltd amounted to R Dr R Cr R Recording of noncontrolling interest in revaluation surplus of Gum Ltd since acquisition to August JOURNAL B Retained earnings x Noncontrolling interests PL x Noncontrolling interests SFP Recording of noncontrolling interest in retained earnings of Gum Ltd since acquisition to August x QUESTION continued REQUIRED: Marks PART A Review the proforma journal entries presented in the question for the Kgalo Ltd Group, and answer the required below: a Determine if the proforma journal entries are correct or not. If it is correct, rewritethe proforma journal entries into your answer sheet. If it is not, provide the correctproforma journal entries. b Discuss the reasons why the journal entries are prepared. Your answer shouldalso include: i the reason for debiting crediting the accounts in the journal. ii How this is treated and disclosed in the financial statements Communication mark logical flow of discussion Take note: Calculations are required. No marks will be awarded for final or total amounts unlessthe amounts are supported by relevant calculations. Journal narrations are not required. Show all calculations and round all amounts to the nearest Rand. Ignore the taxation effect of unrealised profits andor losses, as well as capital gainstax.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock