Question: Question 1 2 & 3 under Suppose ABC stock Put: price at time t of stock i Die+1(s): dividend paid at time + 1 by

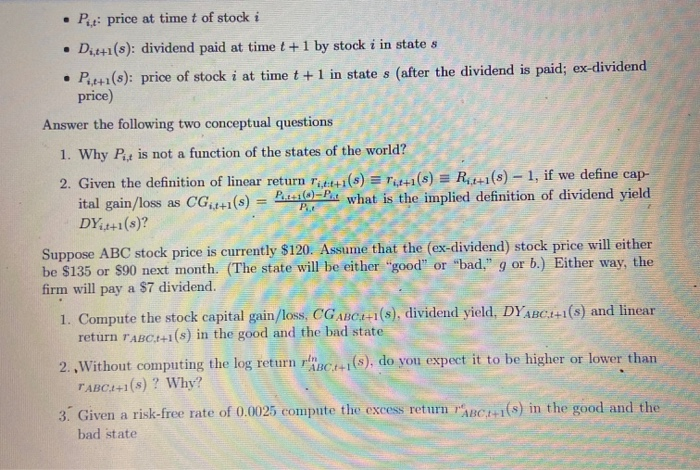

Put: price at time t of stock i Die+1(s): dividend paid at time + 1 by stock i in state s Pue+1(8): price of stock i at time t + 1 in state s (after the dividend is paid; ex-dividend price) Answer the following two conceptual questions 1. Why Pit is not a function of the states of the world? 2. Given the definition of linear return rit:t+1(s) = Tot+1(s) = R.+1(s) - 1, if we define cap- ital gain/loss as CG+:+1(s) = P.x=160) -Pit what is the implied definition of dividend yield DY:+1(s)? Suppose ABC stock price is currently $120. Assume that the (ex-dividend) stock price will either be $135 or $90 next month. The state will be either "good" or "bad," g or b.) Either way, the firm will pay a $7 dividend. 1. Compute the stock capital gain/loss, CG ABC:+1(s), dividend yield, DYABC.4+1(s) and linear return rABC.1+1(s) in the good and the bad state 2. Without computing the log return NBC:+1(), do you expect it to be higher or lower than TABC2+1(8) ? Why? 3. Given a risk-free rate of 0.0025 compute the excess return 'ABC++1(s) in the good and the bad state

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts