Question: QUESTION 1 ( 2 4 marks ) PART A ( 1 6 marks ) In March 2 0 2 4 , Dave received a retrenchment

QUESTION

marks

PART A marks

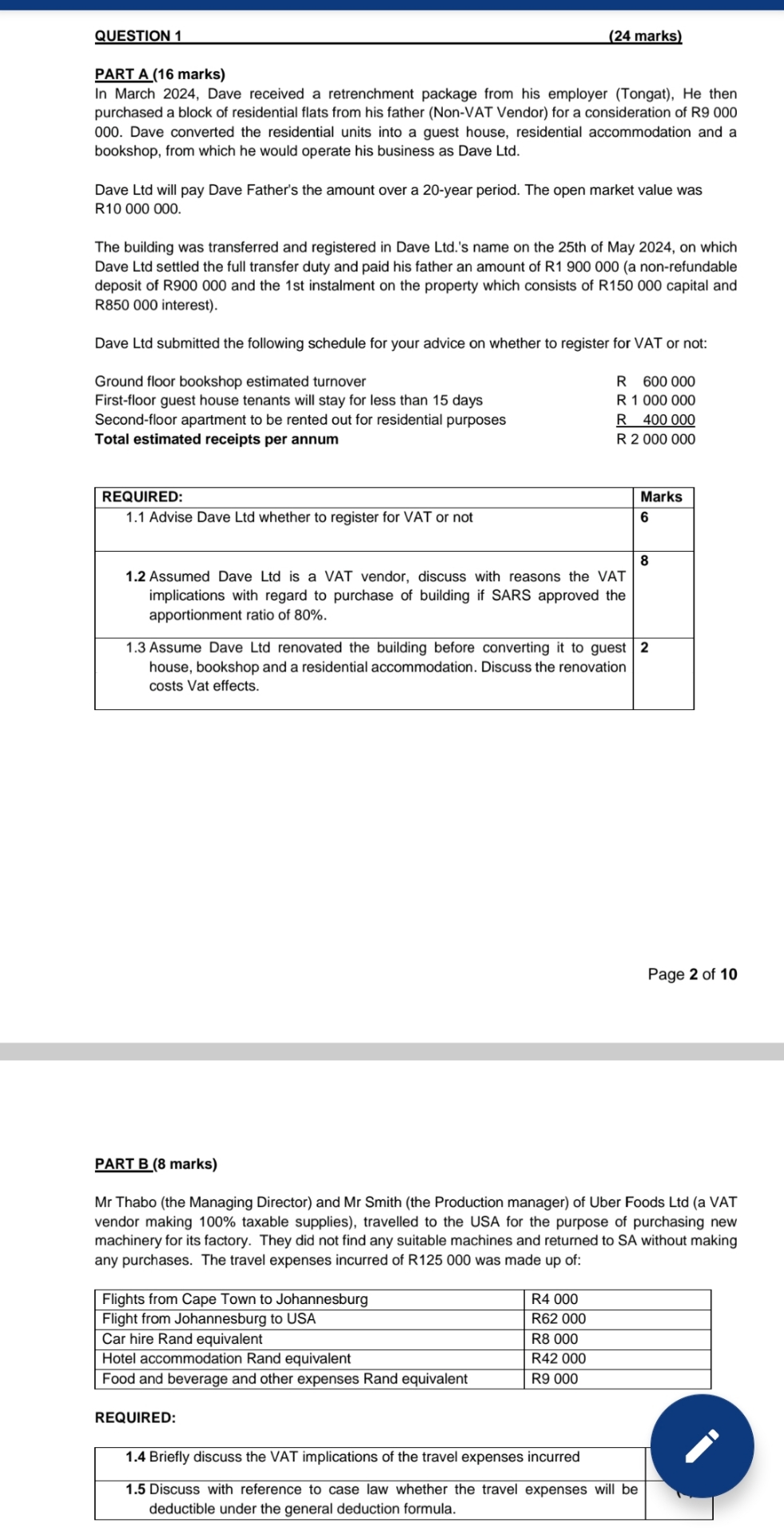

In March Dave received a retrenchment package from his employer Tongat He then purchased a block of residential flats from his father NonVAT Vendor for a consideration of R Dave converted the residential units into a guest house, residential accommodation and a bookshop, from which he would operate his business as Dave Ltd

Dave Ltd will pay Dave Father's the amount over a year period. The open market value was R

The building was transferred and registered in Dave Ltds name on the th of May on which Dave Ltd settled the full transfer duty and paid his father an amount of Ra nonrefundable deposit of R and the st instalment on the property which consists of R capital and R interest

Dave Ltd submitted the following schedule for your advice on whether to register for VAT or not:

Ground floor bookshop estimated turnover

Firstfloor guest house tenants will stay for less than days

Secondfloor apartment to be rented out for residential purposes

Total estimated receipts per annum

R

R

R

R

tableREQUIRED:Marks Advise Dave Ltd whether to register for VAT or not,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock