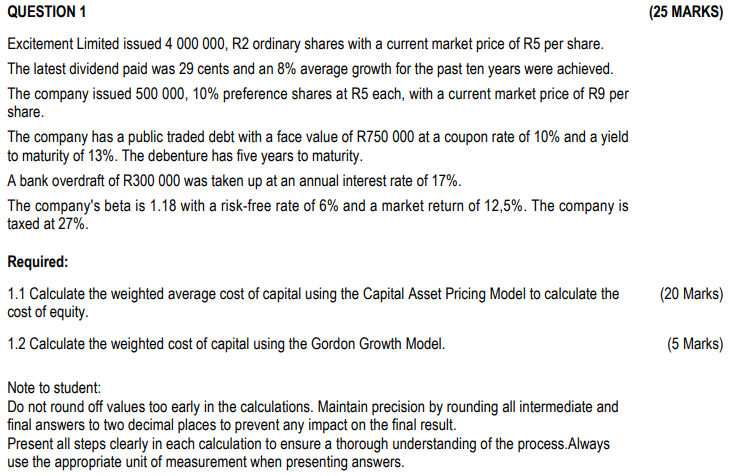

Question: QUESTION 1 ( 2 5 MARKS ) Excitement Limited issued 4 0 0 0 0 0 0 , R 2 ordinary shares with a current

QUESTION MARKS Excitement Limited issued R ordinary shares with a current market price of R per share. The latest dividend paid was cents and an average growth for the past ten years were achieved. The company issued preference shares at R each, with a current market price of R per share. The company has a public traded debt with a face value of R at a coupon rate of and a yield to maturity of The debenture has five years to maturity. A bank overdraft of R was taken up at an annual interest rate of The company's beta is with a riskfree rate of and a market return of The company is taxed at Required: Calculate the weighted average cost of capital using the Capital Asset Pricing Model to calculate the cost of equity. Calculate the weighted cost of capital using the Gordon Growth Model. Note to student: Do not round off values too early in the calculations. Maintain precision by rounding all intermediate and final answers to two decimal places to prevent any impact on the final result. Present all steps clearly in each calculation to ensure a thorough understanding of the process.Always use the appropriate unit of measurement when presenting answers. show market values on a table, then Debentures, Weights, Then Cost of Capital, then WACC, for Calculate the weighted cost of capital using the Gordon Growth Model Marks WACC after

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock