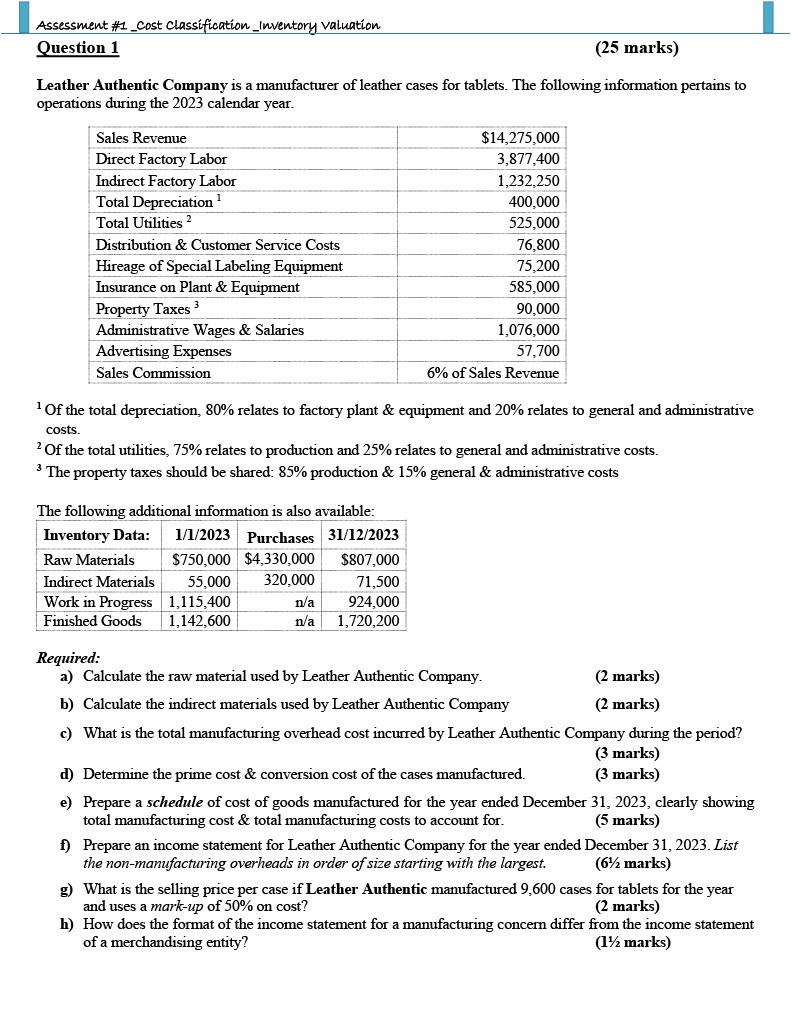

Question: Question 1 ( 2 5 marks ) Leather Authentic Company is a manufacturer of leather cases for tablets. The following information pertains to operations during

Question

marks

Leather Authentic Company is a manufacturer of leather cases for tablets. The following information pertains to

operations during the calendar year.

Of the total depreciation, relates to factory plant & equipment and relates to general and administrative

costs.

Of the total utilities, relates to production and relates to general and administrative costs.

The property taxes should be shared: production & general & administrative costs

The following additional information is also available:

Required:

a Calculate the raw material used by Leather Authentic Company.

marks

b Calculate the indirect materials used by Leather Authentic Company

marks

c What is the total manufacturing overhead cost incurred by Leather Authentic Company during the period?

d Determine the prime cost & conversion cost of the cases manufactured.

e Prepare a schedule of cost of goods manufactured for the year ended December clearly showing

total manufacturing cost & total manufacturing costs to account for.

marks

f Prepare an income statement for Leather Authentic Company for the year ended December List

the nonmanufacturing overheads in order of size starting with the largest.

marks

g What is the selling price per case if Leather Authentic manufactured cases for tablets for the year

and uses a markup of on cost

h How does the format of the income statement for a manufacturing concern differ from the income statement

of a merchandising entity?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock