Question: QUESTION 1 ( 2 5 marks ) Using the relevant information provided in the case study, prepare the following for Established Manufacturers ( Pty )

QUESTION marks Using the relevant information provided in the case study, prepare the following for Established Manufacturers Pty Ltd: A Debtors scheduled for November December and January marks A Cash flow projection for November December and January marks

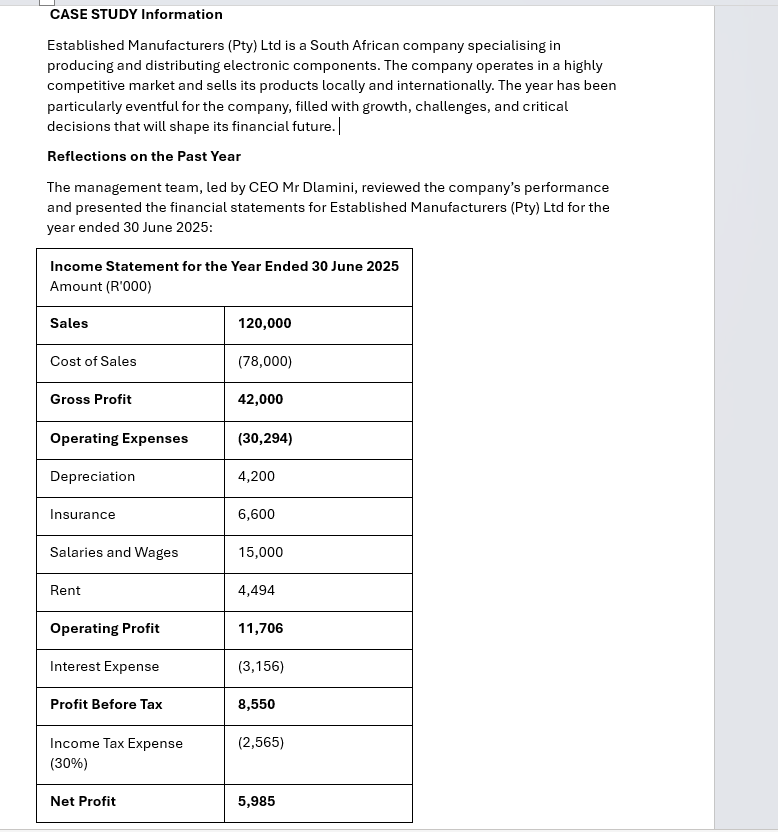

Statement of Financial

Position as of June

Assets

Property, Plant, and

Equipment

Cash and Cash

Equivalents

Total Equity and

Liabilities

The Road Ahead

Looking forward to the next financial year, the management team identified

opportunities and challenges. Sales were evenly distributed over the past months

and are expected to grow by in the next financial year, while the cost of sales

remains constant at of total sales revenue.

Cost pressures are real in the current economy and the following have been identified:

Salaries and Wages were incurred evenly throughout the year. However, this is expected

to increase by after the anticipated industrywide union negotiations in October

Rent is paid quarterly, with the annual increase effective January

Insurance premiums are paid monthly and increase by on July, each year.

Due to planned changes in Established Manufacturers' credit policy, the total value of

debtors is expected to double in the financial year. However, the day payment terms

granted to debtors will remain, despite the widely varying payment patterns.

of credit sales are collected within days.

are collected within days.

are written off as bad debts.

of sales are cash sales, with a discount offered.

Purchases are linked to sales, with monthly purchases equal to of monthly sales.

of purchases are made on credit, with day payment terms. The balance is paid

for in cash.

The total trade creditors at the end of the financial year are envisaged to increase by

Rm YOY, while the opening inventory as of July is expected to be Rm more

than July

A new project will commence in January with a capital investment of R million

to be made in a new truck. While a cash deposit is required days prior, the first

repayment for the truck will be on July Old equipment with a zerobook value

will be sold in October for R with payment terms of days after the sale.

The company maintains a depreciation policy of per annum on a straightline

basis.

The shortterm loan will be extinguished by October while the term loan with

Home Bank has an annual repayment of Rm due on March

The total interest expense for FYE is expected to rise by

Based on the review and discussion, the CFO projected an unfavourable bank balance

of R at the end of October He also mentioned that given the loyalty and

support of the shareholders, it is anticipated a dividend of cents per share will be

declared and paid out in the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock