Question: Question 1 ( 2 5 points ) Recently Jemma Paige the owner of Led Zepplinn Inc. has been looking at her books and realizes she

Question points

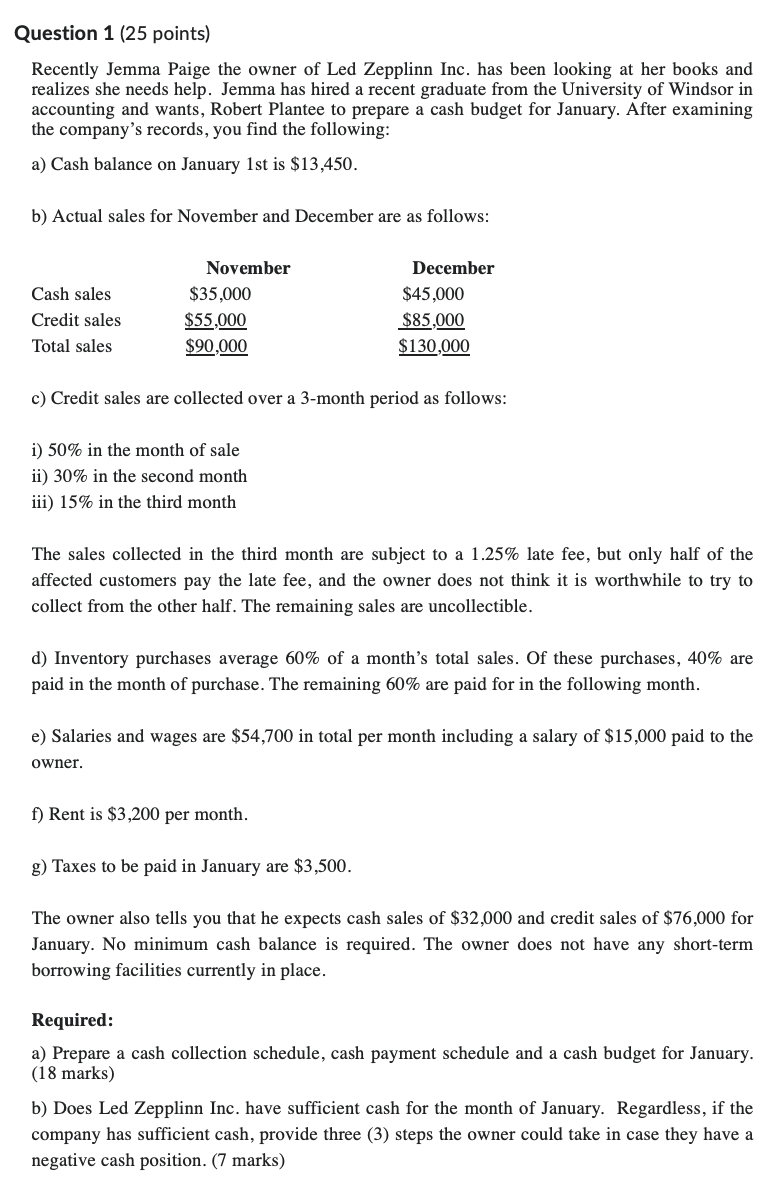

Recently Jemma Paige the owner of Led Zepplinn Inc. has been looking at her books and

realizes she needs help. Jemma has hired a recent graduate from the University of Windsor in

accounting and wants, Robert Plantee to prepare a cash budget for January. After examining

the company's records, you find the following:

a Cash balance on January st is $

b Actual sales for November and December are as follows:

c Credit sales are collected over a month period as follows:

i in the month of sale

ii in the second month

iii in the third month

The sales collected in the third month are subject to a late fee, but only half of the

affected customers pay the late fee, and the owner does not think it is worthwhile to try to

collect from the other half. The remaining sales are uncollectible.

d Inventory purchases average of a month's total sales. Of these purchases, are

paid in the month of purchase. The remaining are paid for in the following month.

e Salaries and wages are $ in total per month including a salary of $ paid to the

owner.

f Rent is $ per month.

g Taxes to be paid in January are $

The owner also tells you that he expects cash sales of $ and credit sales of $ for

January. No minimum cash balance is required. The owner does not have any shortterm

borrowing facilities currently in place.

Required:

a Prepare a cash collection schedule, cash payment schedule and a cash budget for January.

marks

b Does Led Zepplinn Inc. have sufficient cash for the month of January. Regardless, if the

company has sufficient cash, provide three steps the owner could take in case they have a

negative cash position. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock