Question: Question 1 (2 marks) Jim Ltd makes a 1:6 rights issue at 4.10 followed by a 2:7 bonus issue. If pre-rights prices were 4.90 per

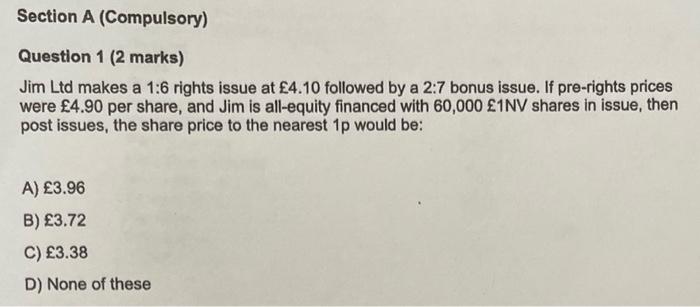

Question 1 (2 marks)

Jim Ltd makes a 1:6 rights issue at 4.10 followed by a 2:7 bonus issue. If pre-rights prices

were 4.90 per share, and Jim is all-equity financed with 60,000 1NV shares in issue, then

post issues, the share price to the nearest 1p would be:

A) 3.96

B) 3.72

C) 3.38

D) None of these

could you please also show working on how you arrived to this answer.

Section A (Compulsory) Question 1 (2 marks) Jim Ltd makes a 1:6 rights issue at 4.10 followed by a 2:7 bonus issue. If pre-rights prices were 4.90 per share, and Jim is all-equity financed with 60,000 1NV shares in issue, then post issues, the share price to the nearest 1p would be: A) 3.96 B) 3.72 C) 3.38 D) None of these

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock