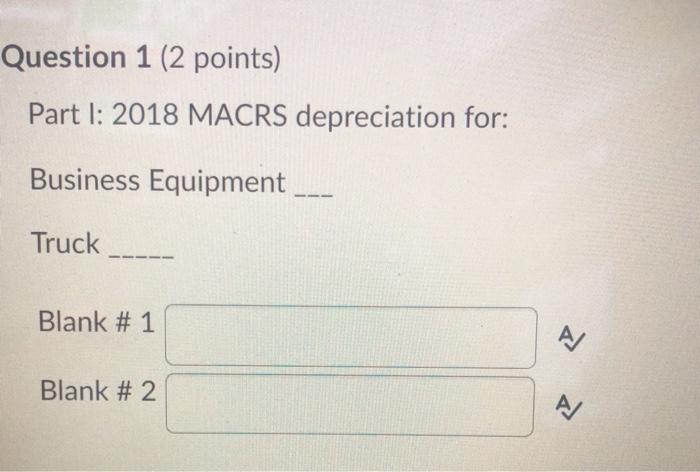

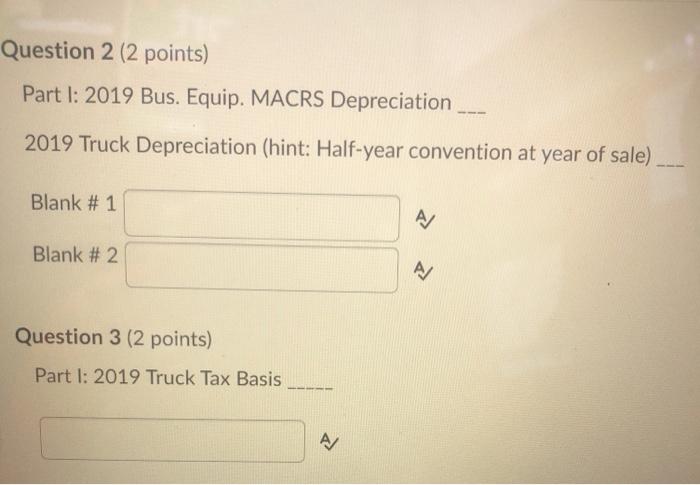

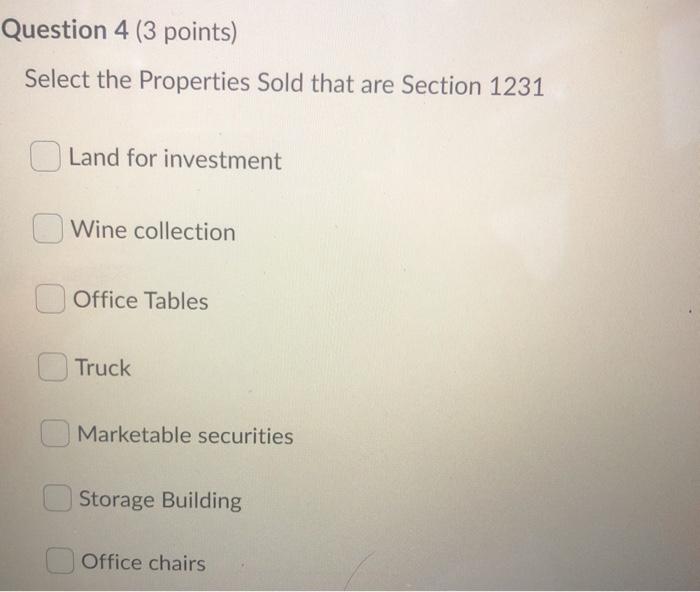

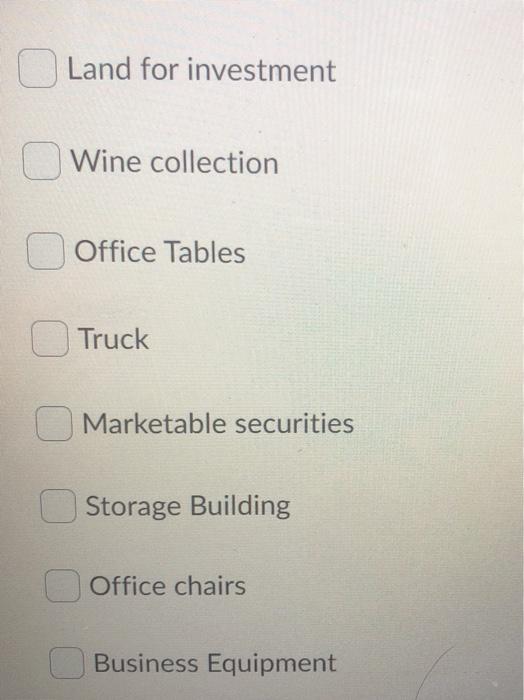

Question: Question 1 (2 points) Part I: 2018 MACRS depreciation for: Business Equipment ___ Truck Blank # 1 A Blank # 2 A Question 2 (2

Question 1 (2 points) Part I: 2018 MACRS depreciation for: Business Equipment ___ Truck Blank # 1 A Blank # 2 A Question 2 (2 points) Part I: 2019 Bus. Equip. MACRS Depreciation 2019 Truck Depreciation (hint: Half-year convention at year of sale) Blank # 1 AJ Blank #2 Question 3 (2 points) Part I: 2019 Truck Tax Basis A/ Question 4 (3 points) Select the Properties Sold that are Section 1231 Land for investment Wine collection Office Tables Truck Marketable securities Storage Building Office chairs Land for investment Wine collection Office Tables Truck Marketable securities Storage Building Office chairs Business Equipment Question 1 (2 points) Part I: 2018 MACRS depreciation for: Business Equipment ___ Truck Blank # 1 A Blank # 2 A Question 2 (2 points) Part I: 2019 Bus. Equip. MACRS Depreciation 2019 Truck Depreciation (hint: Half-year convention at year of sale) Blank # 1 AJ Blank #2 Question 3 (2 points) Part I: 2019 Truck Tax Basis A/ Question 4 (3 points) Select the Properties Sold that are Section 1231 Land for investment Wine collection Office Tables Truck Marketable securities Storage Building Office chairs Land for investment Wine collection Office Tables Truck Marketable securities Storage Building Office chairs Business Equipment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts