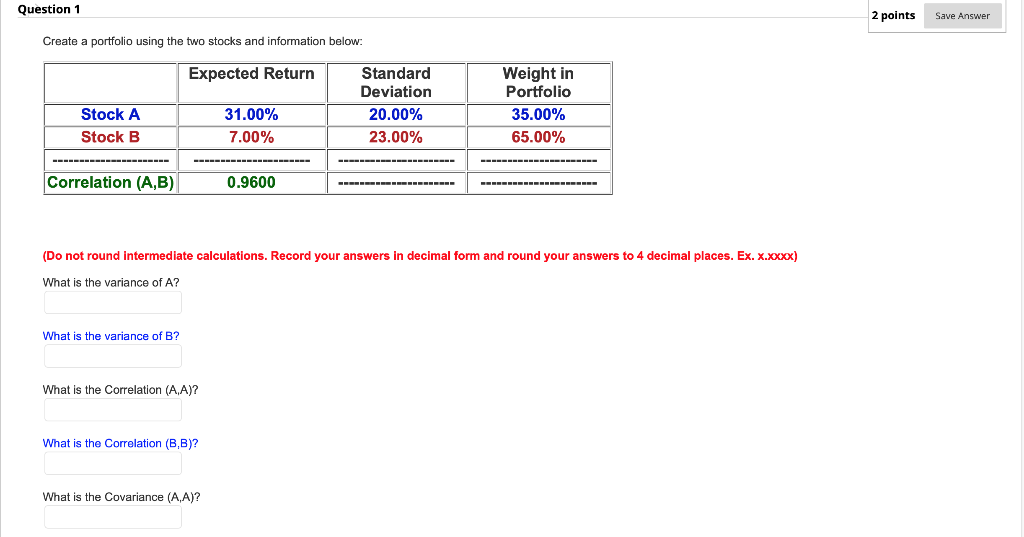

Question: Question 1 2 points Save Answer Create a portfolio using the two stocks and information below: Expected Return Standard Deviation 20.00% 23.00% Weight in Portfolio

Question 1 2 points Save Answer Create a portfolio using the two stocks and information below: Expected Return Standard Deviation 20.00% 23.00% Weight in Portfolio 35.00% 65.00% Stock A Stock B 31.00% 7.00% Correlation (A,B) 0.9600 (Do not round intermediate calculations. Record your answers in decimal form and round your answers to 4 decimal places. Ex. x.xxxx) What is the variance of A? What is the variance of B? What is the Correlation (A,A)? What is the correlation (BB)? What is the Covariance (A,A)? What is the Covariance (A,B)? What is the Covariance (B,A)? What is the Covariance (B,B)? What is the expected return on the portfolio above? What is the variance on the portfolio above? What is the standard deviation on the portfolio above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts