Question: QUESTION 1 2 points Save Antwer XYZ is evaluating a project that would require the purchase of a piece of equipment for 5480,000 today. During

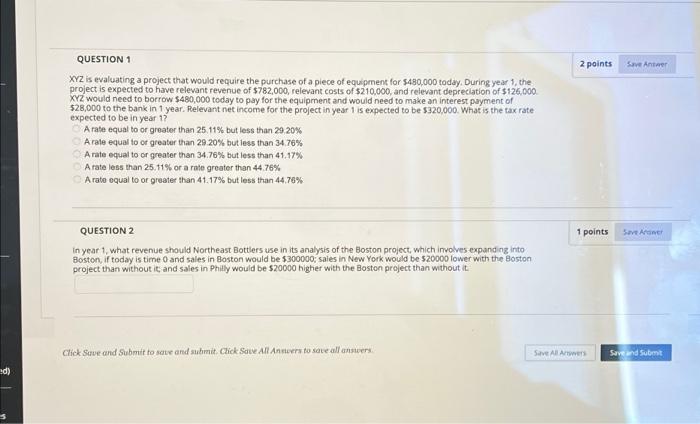

QUESTION 1 2 points Save Antwer XYZ is evaluating a project that would require the purchase of a piece of equipment for 5480,000 today. During year 1, the project is expected to have relevant revenue of $782,000, relevant costs of $210,000, and relevant depreciation of $126,000 XYZ would need to borrow $480,000 today to pay for the equipment and would need to make an interest payment of $28,000 to the bank in 1 year. Relevant net income for the project in year 1 is expected to be $320,000. What is the tax rate expected to be in year 17 A rate equal to or greater than 25.11% but less than 29,20% Arale equal to or greater than 29 20% but less than 34.76% A rate equal to or greater than 34.76% but less than 41.17% A rate less than 25.11% or a rate greater than 44.76% A rate equal to or greater than 41.17% but less than 44.76% 1 points Save A QUESTION 2 in year 1, what revenue should Northeast Bottlers use in its analysis of the Boston project, which involves expanding into Boston, if today is time and sales in Boston would be 5300000, sales in New York would be $20000 lower with the Boston project than without it and sales in Philly would be $20000 higher with the Boston project than without it Click Save and Submit to save and submit. Click Save An Ansor to save all answers Save All Are Save and Subt d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts