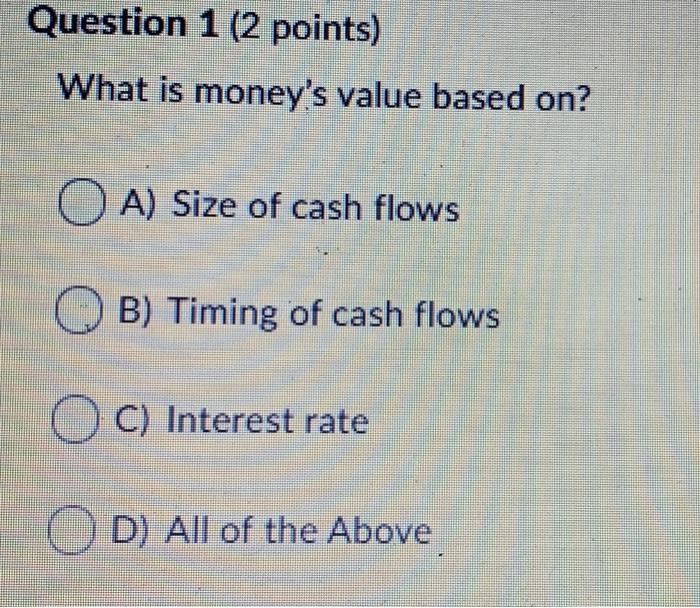

Question: Question 1 (2 points) What is money's value based on? OA) Size of cash flows B) Timing of cash flows C) Interest rate D) All

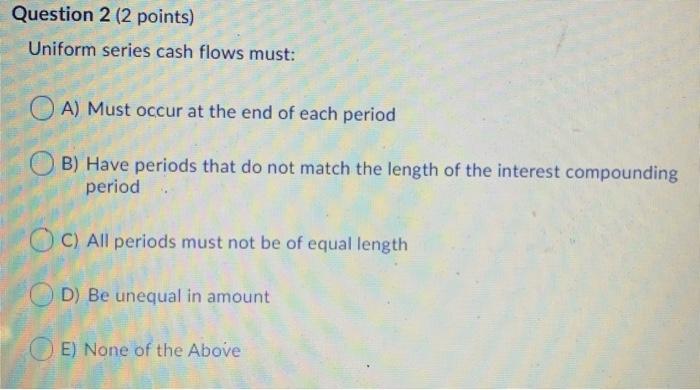

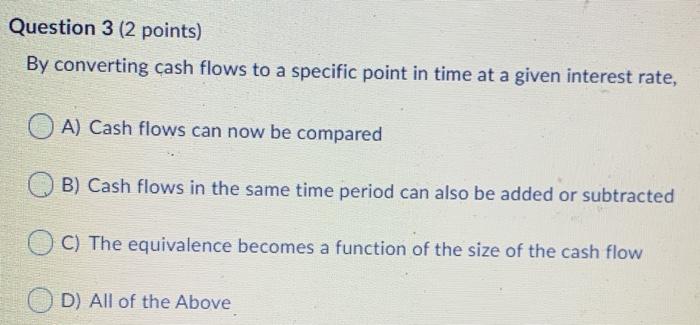

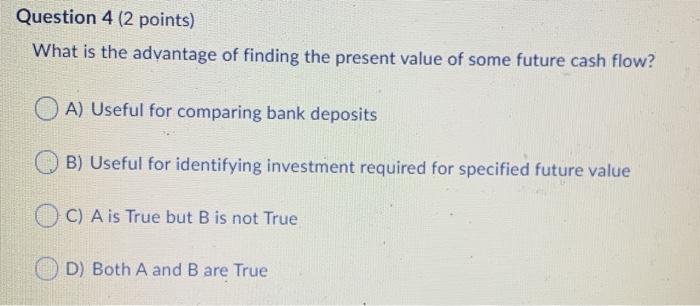

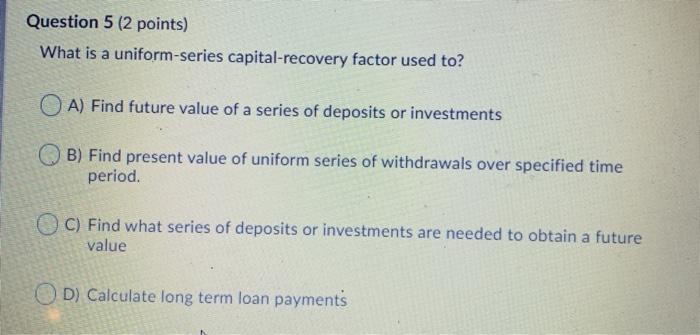

Question 1 (2 points) What is money's value based on? OA) Size of cash flows B) Timing of cash flows C) Interest rate D) All of the Above Question 2 (2 points) Uniform series cash flows must: A) Must occur at the end of each period B) Have periods that do not match the length of the interest compounding period C) All periods must not be of equal length D) Be unequal in amount E) None of the Above Question 3 (2 points) By converting cash flows to a specific point in time at a given interest rate, A) Cash flows can now be compared B) Cash flows in the same time period can also be added or subtracted C) The equivalence becomes a function of the size of the cash flow D) All of the Above Question 4 (2 points) What is the advantage of finding the present value of some future cash flow? OA) Useful for comparing bank deposits B) Useful for identifying investment required for specified future value C) Ais True but B is not True D) Both A and B are True Question 5 (2 points) What is a uniform-series capital-recovery factor used to? OA) Find future value of a series of deposits or investments OB) Find present value of uniform series of withdrawals over specified time period. OC) Find what series of deposits or investments are needed to obtain a future value OD) Calculate long term loan payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts