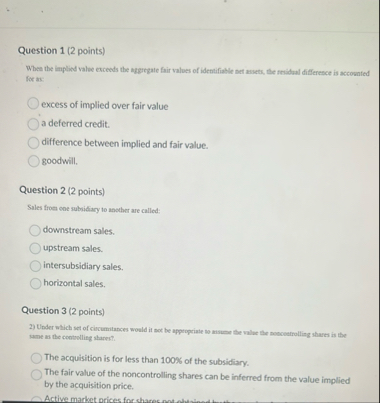

Question: Question 1 ( 2 points ) When the implied value exceeds the agergate fair values of identifiable net assets, the recidual difference is accounted for

Question points

When the implied value exceeds the agergate fair values of identifiable net assets, the recidual difference is accounted for as:

excess of implied over fair value

a deferred credit.

difference between implied and fair value.

goodwill.

Question points

Sales from one subvidiary to another are called:

downstream sales.

upstream sales.

intersubsidiary sales.

horizontal sales.

Question points

Under which set of ciecumitances would it soct be appropriate to misure the value the nowcontrolling shares is the same as the contelling shares?

The acquisition is for less than of the subsidiary.

The fair value of the noncontrolling shares can be inferred from the value implied by the acquisition price.

Active market prices

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock