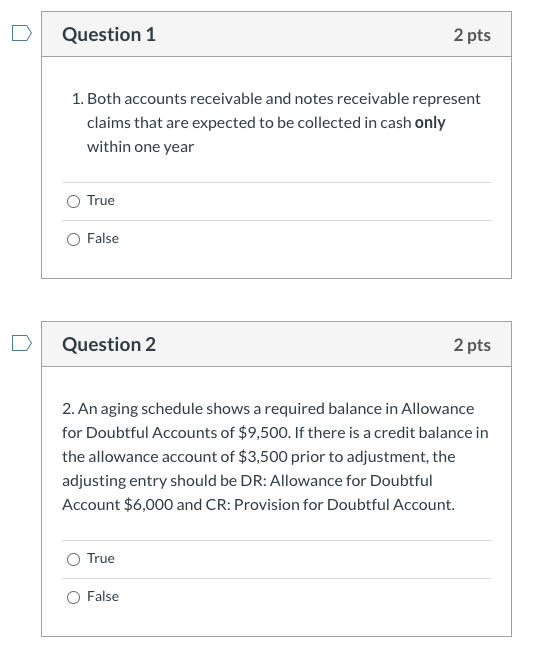

Question: Question 1 2 pts 1. Both accounts receivable and notes receivable represent claims that are expected to be collected in cash only within one year

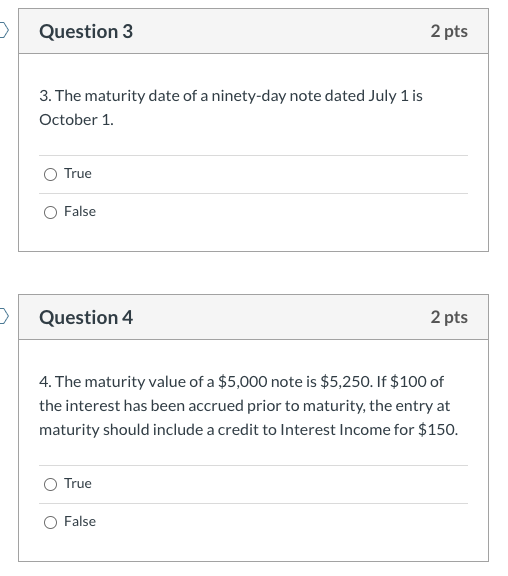

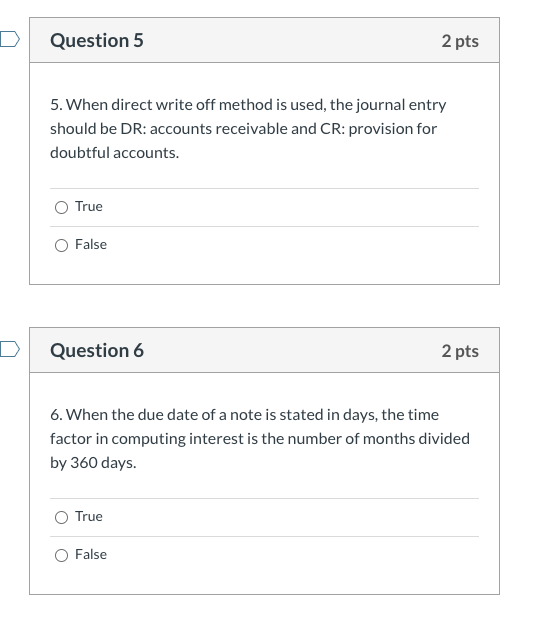

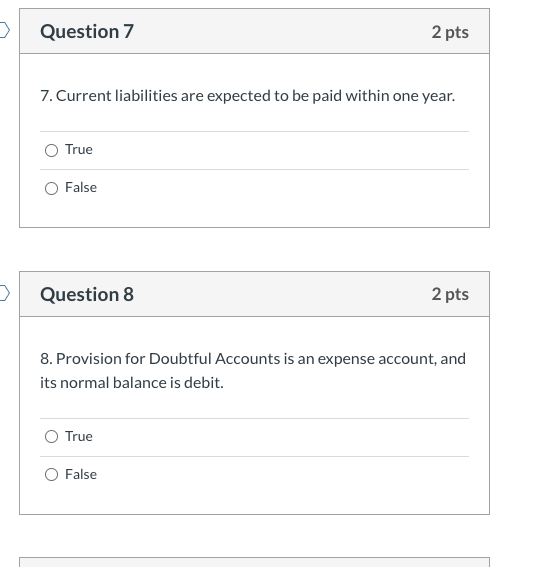

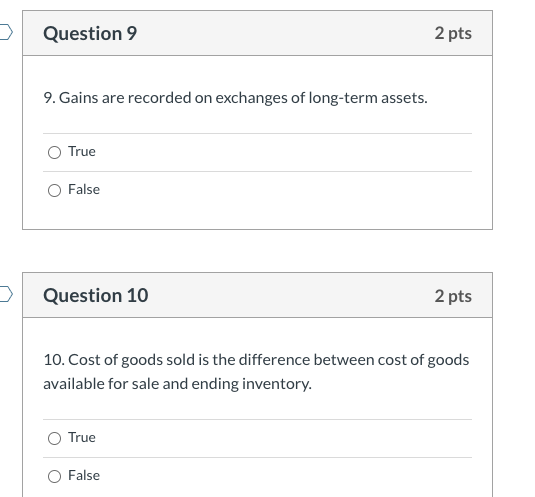

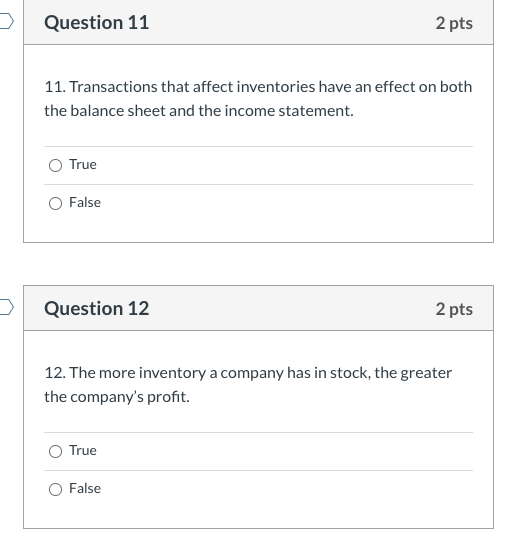

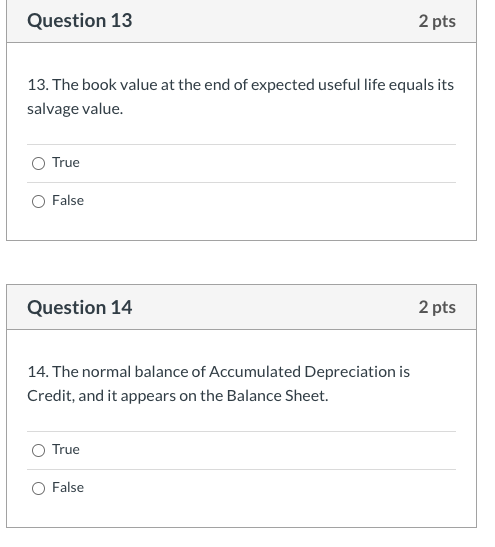

Question 1 2 pts 1. Both accounts receivable and notes receivable represent claims that are expected to be collected in cash only within one year True False Question 2 2 pts 2. An aging schedule shows a required balance in Allowance for Doubtful Accounts of $9,500. If there is a credit balance in the allowance account of $3,500 prior to adjustment, the adjusting entry should be DR: Allowance for Doubtful Account $6,000 and CR: Provision for Doubtful Account. True False Question 3 2 pts 3. The maturity date of a ninety-day note dated July 1 is October 1. True False > Question 4 2 pts 4. The maturity value of a $5,000 note is $5,250. If $100 of the interest has been accrued prior to maturity, the entry at maturity should include a credit to Interest Income for $150. True O False Question 5 2 pts 5. When direct write off method is used, the journal entry should be DR: accounts receivable and CR: provision for doubtful accounts. O True O False D Question 6 2 pts 6. When the due date of a note is stated in days, the time factor in computing interest is the number of months divided by 360 days. True O False Question 7 2 pts 7. Current liabilities are expected to be paid within one year. True False Question 8 2 pts 8. Provision for Doubtful Accounts is an expense account, and its normal balance is debit. O True False Question 9 2 pts 9. Gains are recorded on exchanges of long-term assets. True O False Question 10 2 pts 10. Cost of goods sold is the difference between cost of goods available for sale and ending inventory. O True O False Question 11 2 pts 11. Transactions that affect inventories have an effect on both the balance sheet and the income statement. True False Question 12 2 pts 12. The more inventory a company has in stock, the greater the company's profit. True O False Question 13 2 pts 13. The book value at the end of expected useful life equals its salvage value. O True O False Question 14 2 pts 14. The normal balance of Accumulated Depreciation is Credit, and it appears on the Balance Sheet. True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts