Question: Question 1 2 pts A common application of calculating expected returns is forecasting the expected return of the stock market. For example, if you believe

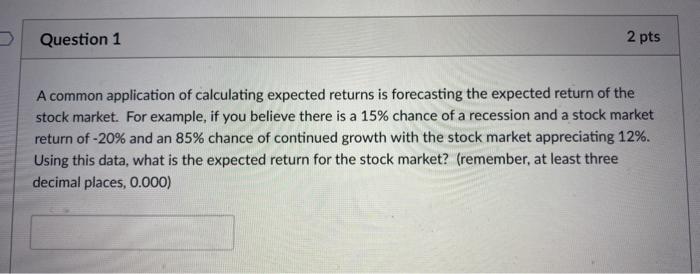

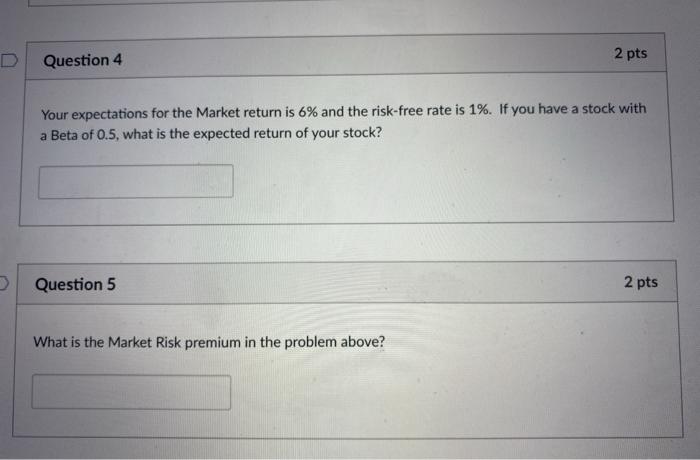

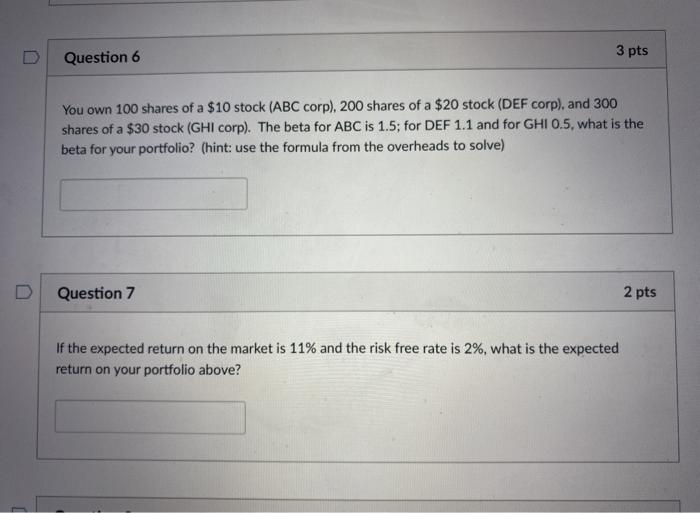

Question 1 2 pts A common application of calculating expected returns is forecasting the expected return of the stock market. For example, if you believe there is a 15% chance of a recession and a stock market return of -20% and an 85% chance of continued growth with the stock market appreciating 12%. Using this data, what is the expected return for the stock market? (remember, at least three decimal places, 0.000) Question 4 2 pts Your expectations for the Market return is 6% and the risk-free rate is 1%. If you have a stock with a Beta of 0.5, what is the expected return of your stock? > Question 5 2 pts What is the Market Risk premium in the problem above? Question 6 3 pts You own 100 shares of a $10 stock (ABC corp), 200 shares of a $20 stock (DEF corp), and 300 shares of a $30 stock (GHI corp). The beta for ABC is 1.5; for DEF 1.1 and for GHI 0.5, what is the beta for your portfolio? (hint: use the formula from the overheads to solve) Question 7 2 pts If the expected return on the market is 11% and the risk free rate is 2%, what is the expected return on your portfolio above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts