Question: Question 1 2 pts A developer wants to finance an apartment building costing $2 million with a LTV of 75%, 20 year 10 loan at

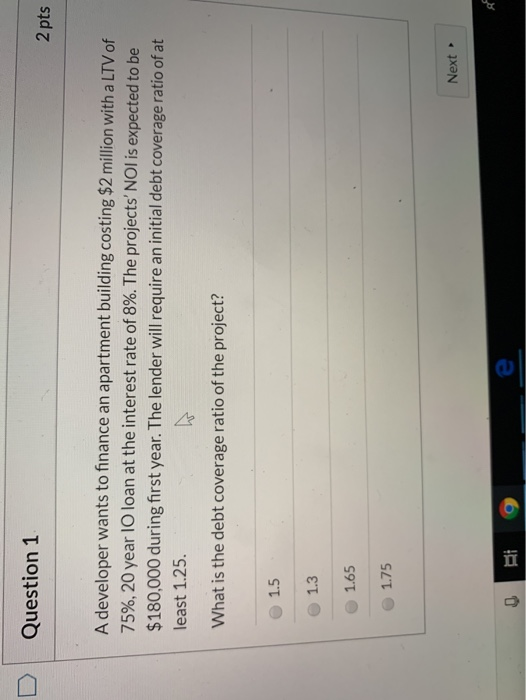

Question 1 2 pts A developer wants to finance an apartment building costing $2 million with a LTV of 75%, 20 year 10 loan at the interest rate of 8%. The projects' NOI is expected to be $180,000 during first year. The lender will require an initial debt coverage ratio of at least 1.25. What is the debt coverage ratio of the project? 1.5 1.3 1.65 1.75 Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock