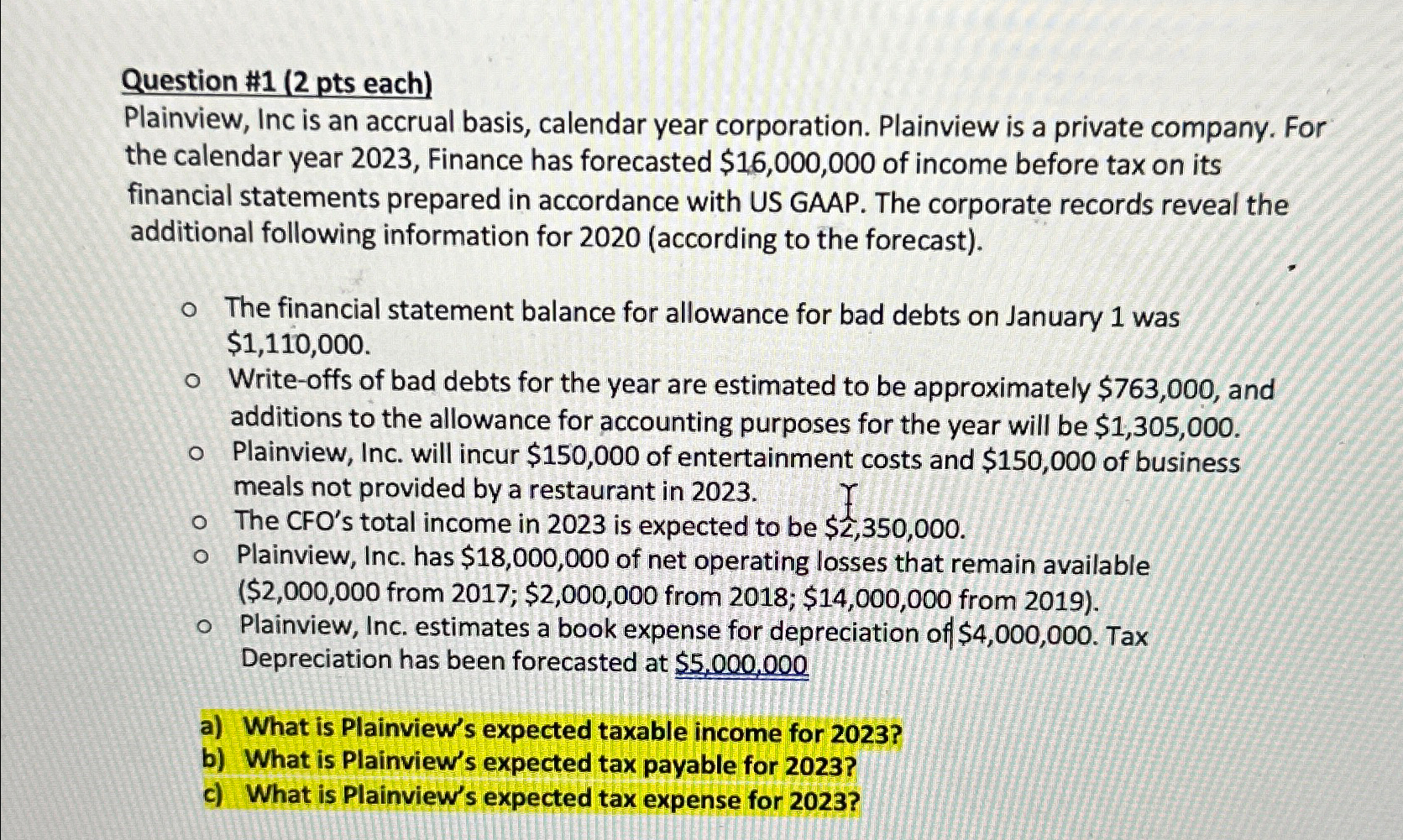

Question: Question # 1 ( 2 pts each ) Plainview, Inc is an accrual basis, calendar year corporation. Plainview is a private company. For the calendar

Question # pts each

Plainview, Inc is an accrual basis, calendar year corporation. Plainview is a private company. For the calendar year Finance has forecasted $ of income before tax on its financial statements prepared in accordance with US GAAP. The corporate records reveal the additional following information for according to the forecast

The financial statement balance for allowance for bad debts on January was $

Writeoffs of bad debts for the year are estimated to be approximately $ and additions to the allowance for accounting purposes for the year will be $

Plainview, Inc. will incur $ of entertainment costs and $ of business meals not provided by a restaurant in

The CFO's total income in is expected to be $

Plainview, Inc. has $ of net operating losses that remain available from ; $ from ;$ from

Plainview, Inc. estimates a book expense for depreciation of $ Tax Depreciation has been forecasted at $

a What is Plainview's expected taxable income for

b What is Plainview's expected tax payable for

c What is Plainview's expected tax expense for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock