Question: question 1 2. Using historical risk premiums from Table 5.5 over the 1927-2018 period as your guide, what would be your estimate of the expected

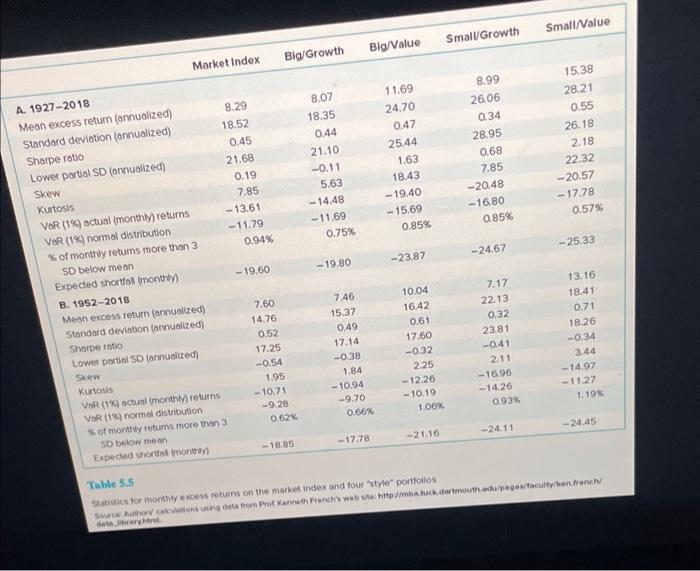

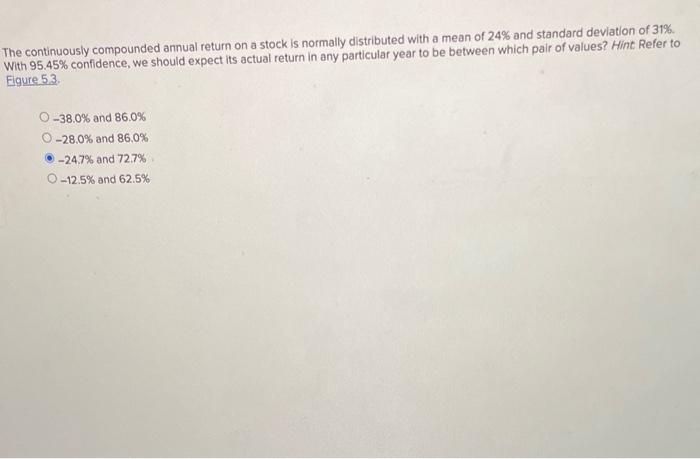

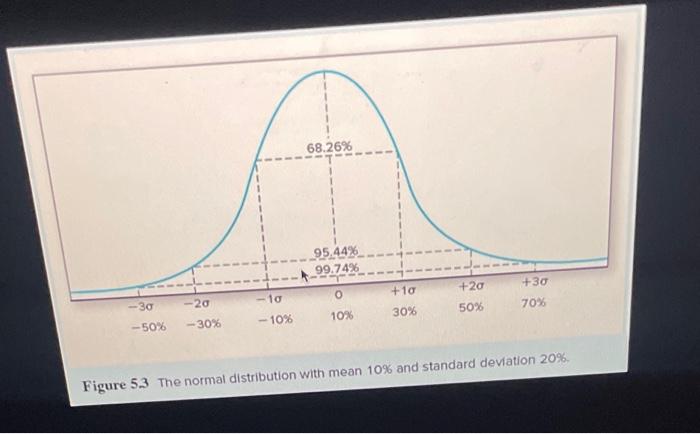

Using historical risk premiums from Table 5.5 over the 1927-2018 period as your guide, what would be your estimate of the expected annual HPR on the Big/Value portfolio if the current risk-free interest rate is 1.70% ? (Round your answer to 2 decimal places.) Table 5.5 Statules for monthiy excess teturis on the market index and four "style* portfollos The continuously compounded annual return on a stock is normally distributed with a mean of 24% and standard deviation of 31%. With 95.45% confidence, we should expect its actual return in any particular year to be between which pair of values? Hint Refer to Elgure 53. 38.0% and 86.0% 28.0% and 86.0% 24.7% and 72.7% 12.5% and 62.5% Figure 5.3 The normal distribution with mean 10% and standard devation 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts