Question: Question 1 2 What does the expense recognition ( matching ) principle state? The expense recognition ( matching ) principle states that expenses should be

Question

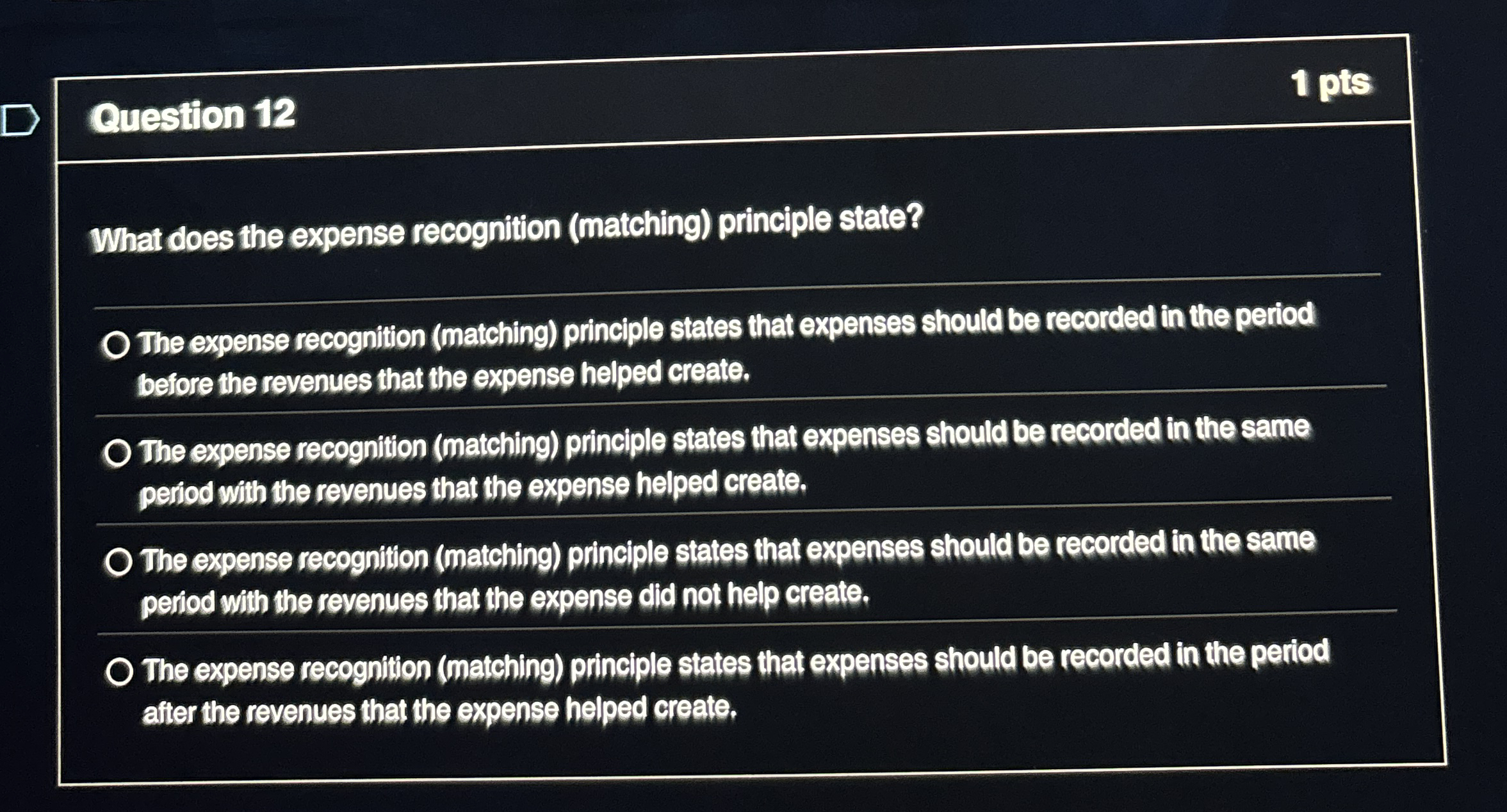

What does the expense recognition matching principle state?

The expense recognition matching principle states that expenses should be recorded in the period before the revenues that the expense helped create.

The expense recognition matching principle states that expenses should be recorded in the same period with the revenues that the expense helped create.

The expense recognition matching principle states that expenses should be recorded in the same period with the revenues that the expense did not help create.

The expense recognition matching principle states that expenses should be recorded in the period after the revenues that the expense helped create.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock