Question: Question 1 (20 marks) a) (2 marks) Please retrieve the following zero rates from the Bank of Canada's web- site and use the data

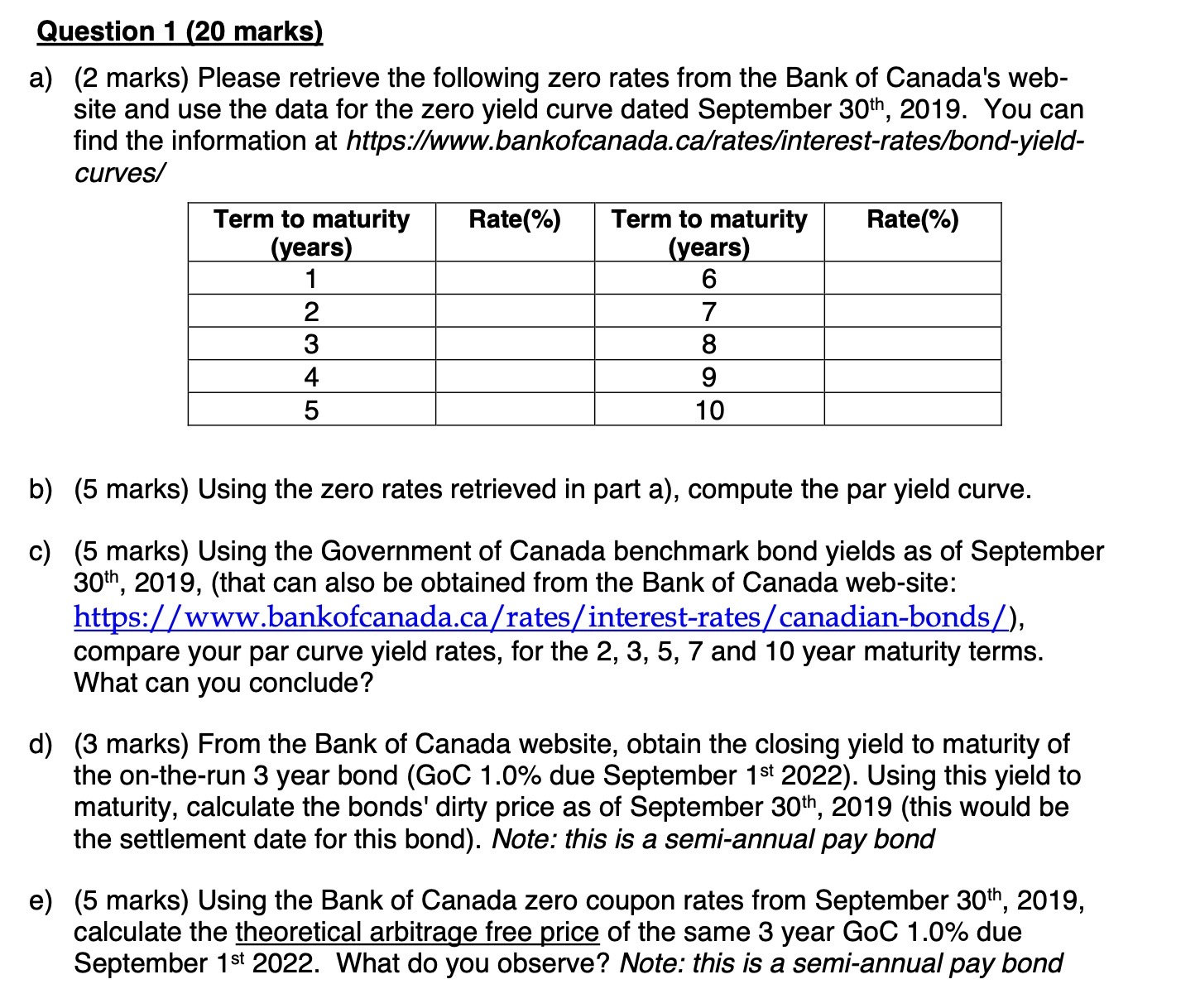

Question 1 (20 marks) a) (2 marks) Please retrieve the following zero rates from the Bank of Canada's web- site and use the data for the zero yield curve dated September 30th, 2019. You can find the information at https://www.bankofcanada.ca/rates/interest-rates/bond-yield- curves/ Term to maturity Rate(%) Term to maturity Rate(%) (years) 1 (years) 6 2 3 4 5 7 8 9 10 b) (5 marks) Using the zero rates retrieved in part a), compute the par yield curve. c) (5 marks) Using the Government of Canada benchmark bond yields as of September 30th, 2019, (that can also be obtained from the Bank of Canada web-site: https://www.bankofcanada.ca/rates/interest-rates/canadian-bonds/), compare your par curve yield rates, for the 2, 3, 5, 7 and 10 year maturity terms. What can you conclude? d) (3 marks) From the Bank of Canada website, obtain the closing yield to maturity of the on-the-run 3 year bond (GoC 1.0% due September 1st 2022). Using this yield to maturity, calculate the bonds' dirty price as of September 30th, 2019 (this would be the settlement date for this bond). Note: this is a semi-annual pay bond e) (5 marks) Using the Bank of Canada zero coupon rates from September 30th, 2019, calculate the theoretical arbitrage free price of the same 3 year GoC 1.0% due September 1st 2022. What do you observe? Note: this is a semi-annual pay bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts