Question: Question #1 ( 20 Marks ) a) ABC Company is preparing their year-end financial statements. On December 31, 2021, the balance in Accounts Receivable was

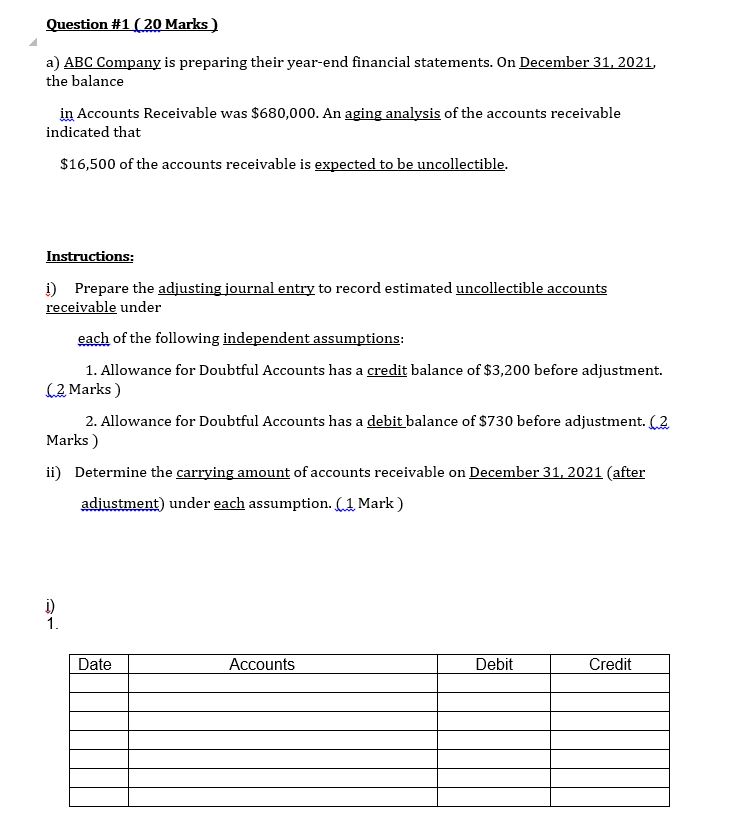

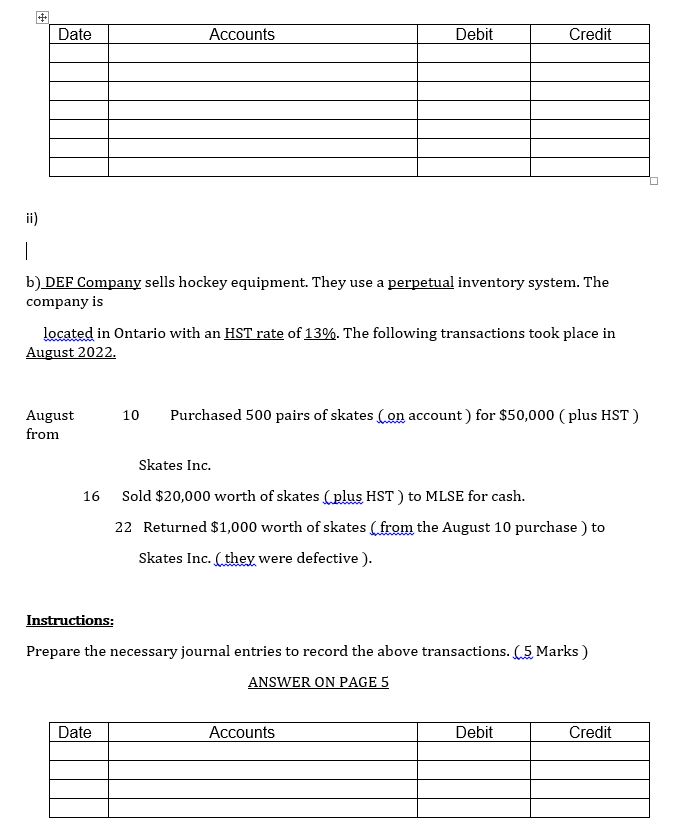

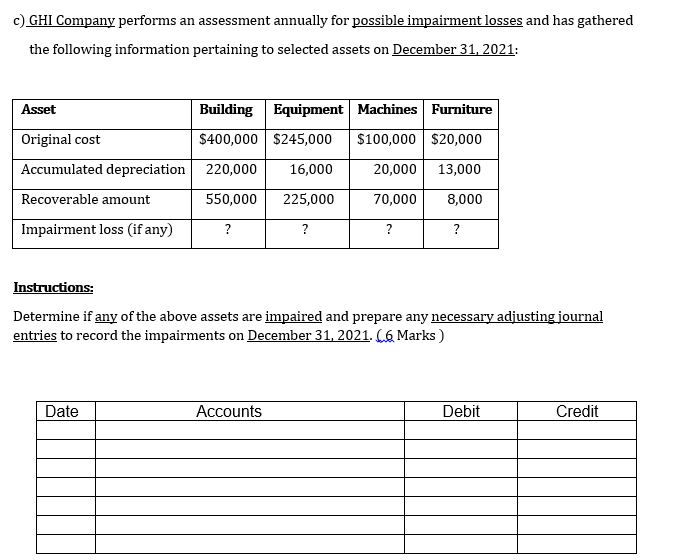

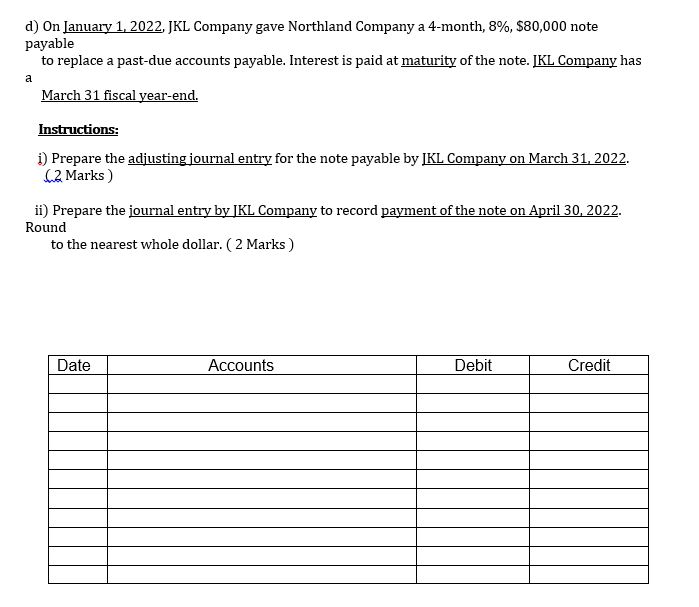

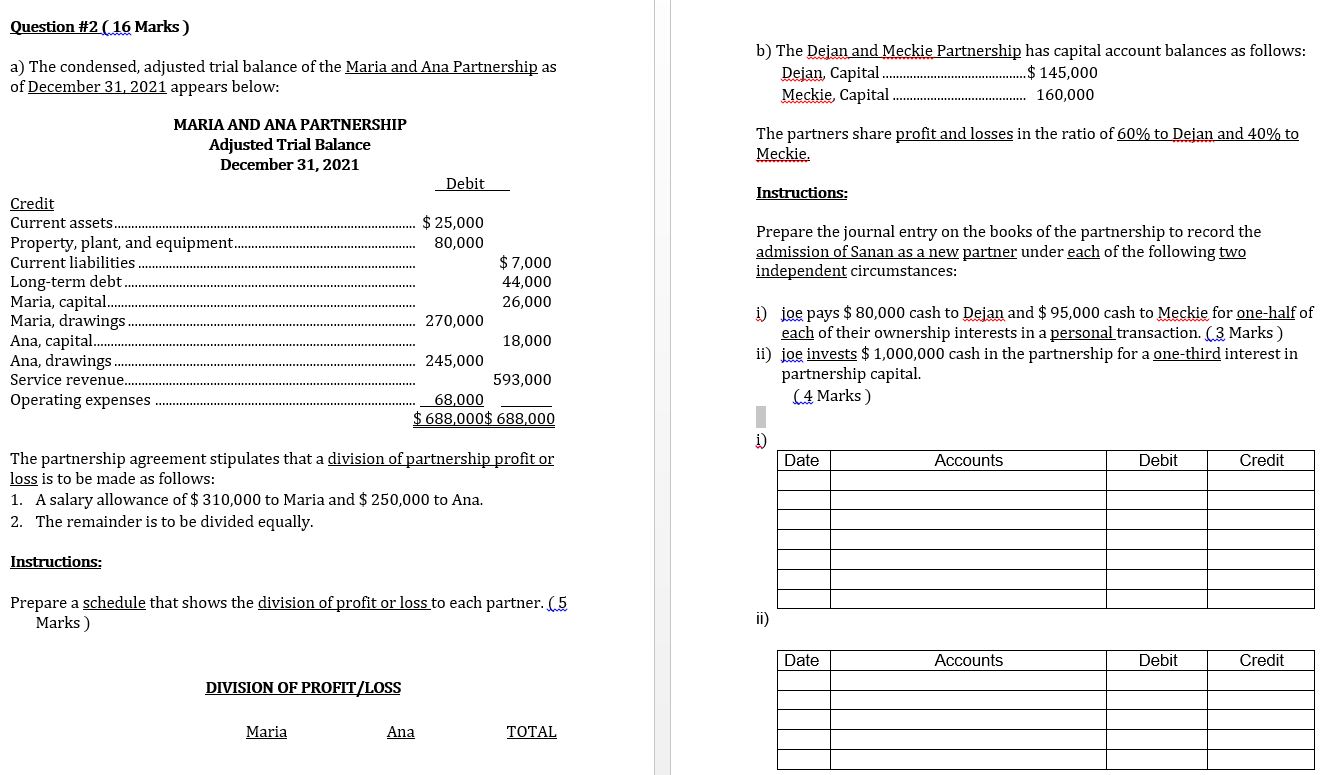

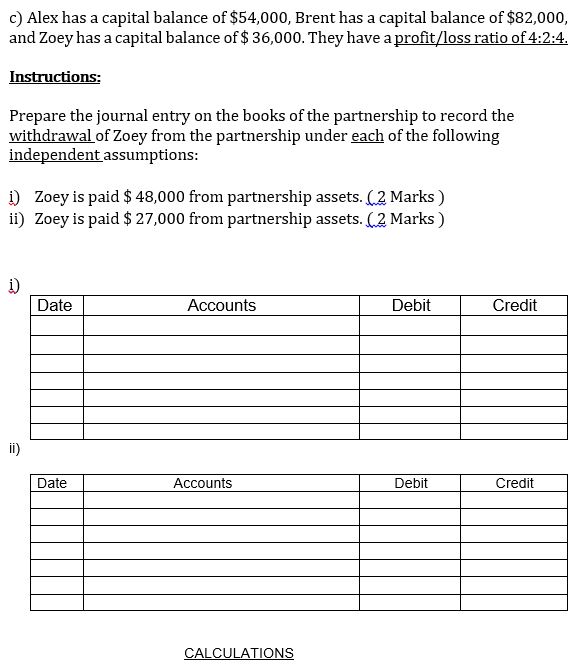

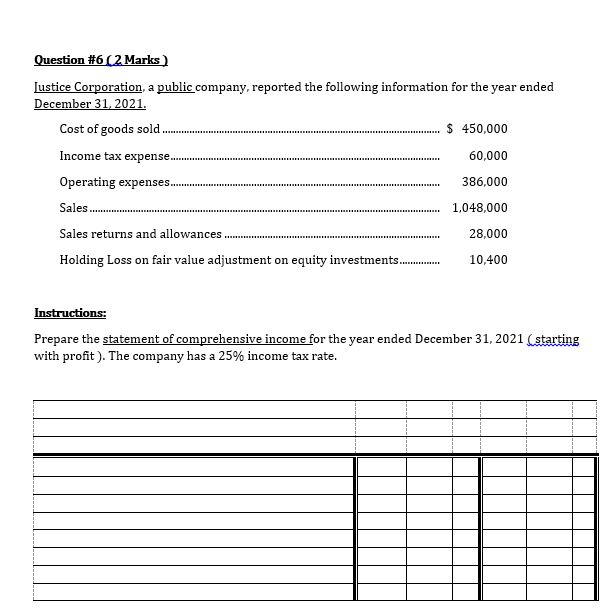

Question #1 ( 20 Marks ) a) ABC Company is preparing their year-end financial statements. On December 31, 2021, the balance in Accounts Receivable was $680,000. An aging analysis of the accounts receivable indicated that $16,500 of the accounts receivable is expected to be uncollectible. Instructions: i) Prepare the adjusting journal entry to record estimated uncollectible accounts receivable under each of the following independent assumptions: 1. Allowance for Doubtful Accounts has a credit balance of $3,200 before adjustment. (2 Marks ) 2. Allowance for Doubtful Accounts has a debit balance of $730 before adjustment. ( 2 Marks ) ii) Determine the carrying amount of accounts receivable on December 31, 2021 (after adjustment) under each assumption. (1 Mark ) Date Accounts Debit CreditDate Accounts Debit Credit ii) b) DEF Company sells hockey equipment. They use a perpetual inventory system. The company is located in Ontario with an HST rate of 13%. The following transactions took place in August 2022. August 10 Purchased 500 pairs of skates ( on account ) for $50,000 ( plus HST ) from Skates Inc. 16 Sold $20,000 worth of skates ( plus HST ) to MLSE for cash. 22 Returned $1,000 worth of skates ( from the August 10 purchase ) to Skates Inc. ( they were defective ). Instructions; Prepare the necessary journal entries to record the above transactions. (.5 Marks ) ANSWER ON PAGE 5 Date Accounts Debit Creditc) GHI Company performs an assessment annually for possible impairment losses and has gathered the following information pertaining to selected assets on December 31, 2021: Asset Building Equipment Machines Furniture Original cost $400,000 $245,000 $100,000 $20,000 Accumulated depreciation 220,000 16,000 20,000 13,000 Recoverable amount 550,000 225,000 70,000 8,000 Impairment loss (if any) ? ? ? Instructions: Determine if any of the above assets are impaired and prepare any necessary adjusting journal entries to record the impairments on December 31, 2021. (6 Marks ) Date Accounts Debit Creditd) On January 1, 2022, JKL Company gave Northland Company a 4-month, 8%, $80,000 note payable to replace a past-due accounts payable. Interest is paid at maturity of the note. JKL Company has a March 31 fiscal year-end. Instructions: i) Prepare the adjusting journal entry for the note payable by JKL Company on March 31, 2022. ( 2 Marks ) ii) Prepare the journal entry by JKL Company to record payment of the note on April 30, 2022. Round to the nearest whole dollar. ( 2 Marks ) Date Accounts Debit CreditQuestion #2 ( 16 Marks ) b) The Dejan and Meckie Partnership has capital account balances as follows: a) The condensed, adjusted trial balance of the Maria and Ana Partnership as Dejan, Capital . .$ 145,000 of December 31, 2021 appears below: Meckie, Capital. ........ 160,000 MARIA AND ANA PARTNERSHIP Adjusted Trial Balance The partners share profit and losses in the ratio of 60% to Dejan and 40% to December 31, 2021 Meckie. Debit Instructions: Credit Current assets ....." $ 25,000 80,000 Prepare the journal entry on the books of the partnership to record the Property, plant, and equipment.. Current liabilities .. $ 7,000 admission of Sanan as a new partner under each of the following two Long-term debt .. 44,000 independent circumstances: Maria, capital... 26,000 Maria, drawings .... 270,000 i) joe pays $ 80,000 cash to Dejan and $ 95,000 cash to Meckie for one-half of Ana, capital. 18,000 each of their ownership interests in a personal transaction. ( 3 Marks ) Ana, drawings .........."' *.....:... 245,000 ii) joe invests $ 1,000,000 cash in the partnership for a one-third interest in Service revenue. 593,000 partnership capital. Operating expenses .... 68,000 (4 Marks ) $ 688,000$ 688,000 The partnership agreement stipulates that a division of partnership profit or Date Accounts Debit Credit loss is to be made as follows: 1. A salary allowance of $ 310,000 to Maria and $ 250,000 to Ana. 2. The remainder is to be divided equally. Instructions: Prepare a schedule that shows the division of profit or loss to each partner. (5 Marks) ii) Date Accounts Debit Credit DIVISION OF PROFIT/LOSS Maria Ana TOTAL\f\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts