Question: QUESTION 1 (20 MARKS) (a) Define: i. Systematic Risk. ii. Unsystematic Risk. (3 marks) (b) As a financial manager, you have been asked for an

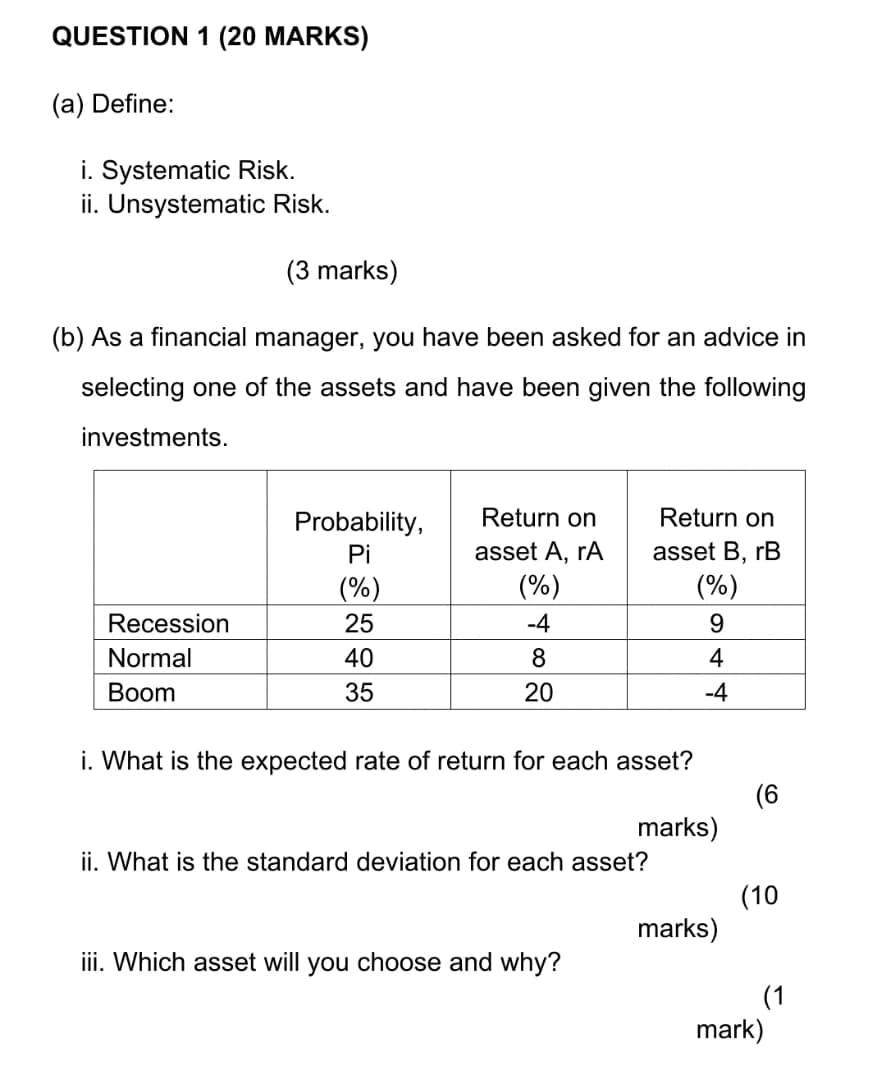

QUESTION 1 (20 MARKS) (a) Define: i. Systematic Risk. ii. Unsystematic Risk. (3 marks) (b) As a financial manager, you have been asked for an advice in selecting one of the assets and have been given the following investments. Probability, Pi (%) 25 40 35 Return on asset A, CA (%) -4 Return on asset B, rB (%) 9 4 Recession Normal Boom 8 20 -4 i. What is the expected rate of return for each asset? (6 marks) ii. What is the standard deviation for each asset? (10 marks) iii. Which asset will you choose and why? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts