Question: Question 1 (20 marks) (a) Explain the differences between annual percentage rate (APR) and effective annual rate (EAR). (3 marks) (b) Phoebe is considering selling

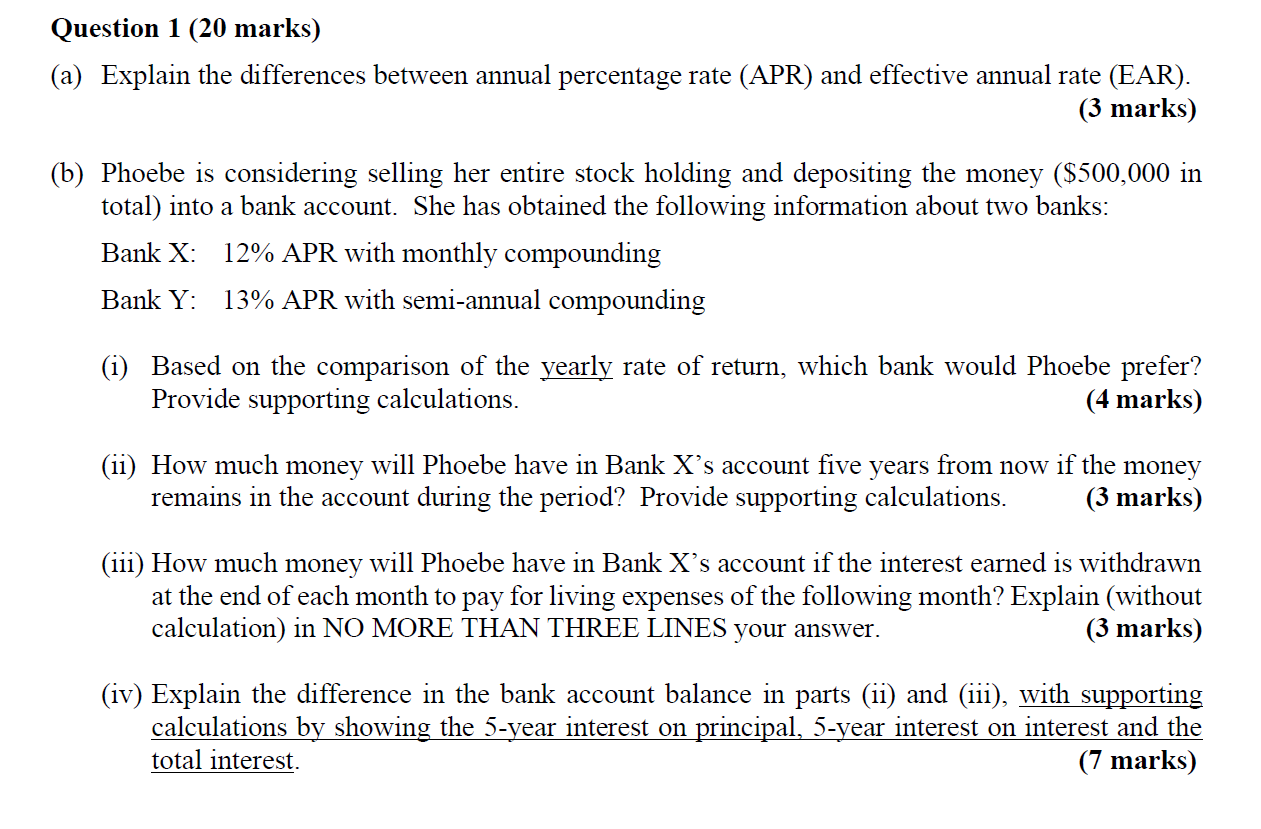

Question 1 (20 marks) (a) Explain the differences between annual percentage rate (APR) and effective annual rate (EAR). (3 marks) (b) Phoebe is considering selling her entire stock holding and depositing the money ($500,000 in total) into a bank account. She has obtained the following information about two banks: Bank X: 12% APR with monthly compounding Bank Y: 13% APR with semi-annual compounding (i) Based on the comparison of the yearly rate of return, which bank would Phoebe prefer? Provide supporting calculations. (4 marks) (ii) How much money will Phoebe have in Bank X's account five years from now if the money remains in the account during the period? Provide supporting calculations. (3 marks) (iii) How much money will Phoebe have in Bank X's account if the interest earned is withdrawn at the end of each month to pay for living expenses of the following month? Explain (without calculation) in NO MORE THAN THREE LINES your answer. (3 marks) (iv) Explain the difference in the bank account balance in parts (ii) and (iii), with supporting calculations by showing the 5-year interest on principal, 5-year interest on interest and the total interest (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts