Question: Question 1 (20 marks) (a) We are analyzing a project and have gathered the following data. Based on this data, what is the average accounting

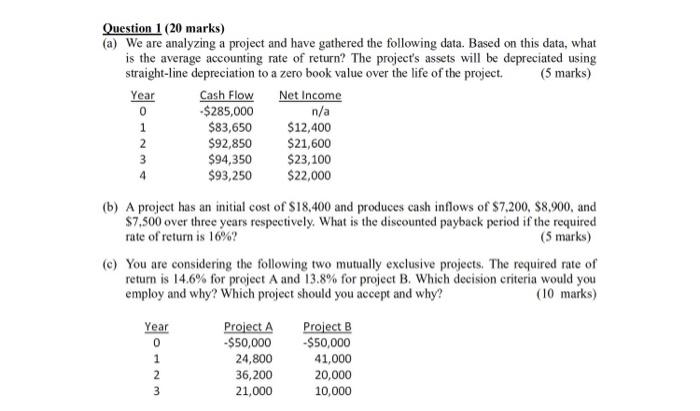

Question 1 (20 marks) (a) We are analyzing a project and have gathered the following data. Based on this data, what is the average accounting rate of return? The project's assets will be depreciated using straight-line depreciation to a zero book value over the life of the project. (5 marks) Year Cash Flow Net Income 0 $285,000 n/a 1 $83,650 $12,400 2 $92,850 $21,600 3 $94,350 $23,100 4 $93,250 $22,000 (b) A project has an initial cost of $18,400 and produces cash inflows of S7,200, 88,900, and $7.500 over three years respectively. What is the discounted payback period if the required rate of return is 10%? (5 marks) (e) You are considering the following two mutually exclusive projects. The required rate of return is 14.6% for project A and 13.8% for project B. Which decision criteria would you employ and why? Which project should you accept and why? (10 marks) Year Project A Project B -$50,000 -$50,000 1 24,800 41,000 2 36,200 20,000 21,000 10,000 0 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts