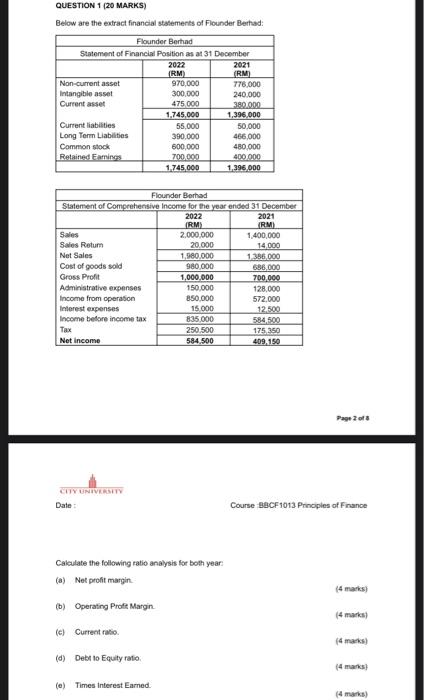

Question: QUESTION 1 (20 MARKS) Below are the extract financial statements of Flounder Berhad: Flounder Berhad Statement of Financial Position as at 31 December 2022

QUESTION 1 (20 MARKS) Below are the extract financial statements of Flounder Berhad: Flounder Berhad Statement of Financial Position as at 31 December 2022 (RM) Non-current asset Intangible asset Current asset Current liabilities Long Term Liabilities Common stock Retained Earnings Sales Sales Return Net Sales Cost of goods sold Gross Profit Administrative expenses Income from operation Interest expenses Income before income tax Tax Net income CITY UNIVERSITY Date: (c) Current ratio. 970,000 300,000 Flounder Berhad Statement of Comprehensive Income for the year ended 31 December 2022 (RM) 2,000,000 20,000 (d) Debt to Equity ratio 475,000 1,745,000 (e) Times Interest Earned. 55,000 390,000 600,000 700,000 1,745,000 1,980,000 980,000 Calculate the following ratio analysis for both year: (a) Net profit margin (b) Operating Profit Margin 1,000,000 150.000 850,000 15.000 835,000 250.500 584,500 2021 (RM) 776,000 240.000 380.000 1,396,000 50,000 466,000 480.000 400.000 1,396,000 2021 (RM) 1,400,000 14,000 1,386,000 686,000 700,000 128,000 572,000 12.500 584,500 175.350 409,150 Page 2 of 8 Course BBCF1013 Principles of Finance (4 marks) (4 marks) (4 marks) (4 marks) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

This question pertains to financial ratio analysis using the provided Statement of Financial Position Balance Sheet and Statement of Comprehensive Inc... View full answer

Get step-by-step solutions from verified subject matter experts