Question: QUESTION 1 (20 Marks) Chowdown Inc. is assessing the construction of a new food processing plant. To date $0.75 million has been spent to identify

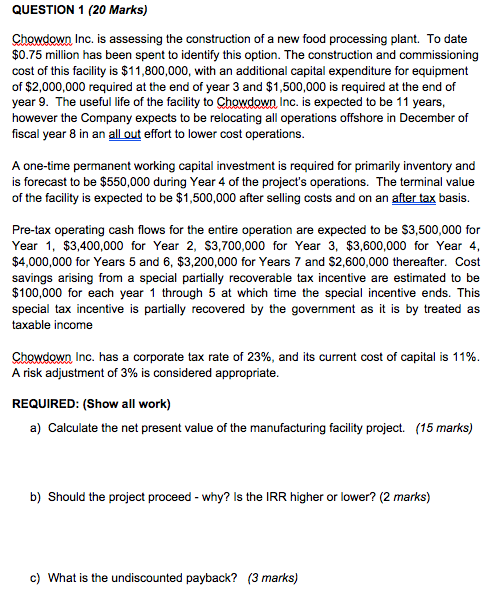

QUESTION 1 (20 Marks) Chowdown Inc. is assessing the construction of a new food processing plant. To date $0.75 million has been spent to identify this option. The construction and commissioning cost of this facility is $11,800,000, with an additional capital expenditure for equipment of $2,000,000 required at the end of year 3 and $1,500,000 is required at the end of year 9. The useful life of the facility to Chowdown Inc. is expected to be 11 years, however the Company expects to be relocating all operations offshore in December of fiscal year 8 in an all out effort to lower cost operations. A one-time permanent working capital investment is required for primarily inventory and is forecast to be $550,000 during Year 4 of the project's operations. The terminal value of the facility is expected to be $1,500,000 after selling costs and on an after tax basis. Pre-tax operating cash flows for the entire operation are expected to be $3,500,000 for Year 1, $3,400,000 for Year 2, $3,700,000 for Year 3, $3,600,000 for Year 4, $4,000,000 for Years 5 and 6, $3,200,000 for Years 7 and $2,600,000 thereafter. Cost savings arising from a special partially recoverable tax incentive are estimated to be $100,000 for each year 1 through 5 at which time the special incentive ends. This special tax incentive is partially recovered by the government as it is by treated as taxable income Chowdown Inc. has a corporate tax rate of 23%, and its current cost of capital is 11%. A risk adjustment of 3% is considered appropriate. REQUIRED: (Show all work) a) Calculate the net present value of the manufacturing facility project. (15 marks) b) Should the project proceed - why? Is the IRR higher or lower? (2 marks) c) What is the undiscounted payback? (3 marks) QUESTION 1 (20 Marks) Chowdown Inc. is assessing the construction of a new food processing plant. To date $0.75 million has been spent to identify this option. The construction and commissioning cost of this facility is $11,800,000, with an additional capital expenditure for equipment of $2,000,000 required at the end of year 3 and $1,500,000 is required at the end of year 9. The useful life of the facility to Chowdown Inc. is expected to be 11 years, however the Company expects to be relocating all operations offshore in December of fiscal year 8 in an all out effort to lower cost operations. A one-time permanent working capital investment is required for primarily inventory and is forecast to be $550,000 during Year 4 of the project's operations. The terminal value of the facility is expected to be $1,500,000 after selling costs and on an after tax basis. Pre-tax operating cash flows for the entire operation are expected to be $3,500,000 for Year 1, $3,400,000 for Year 2, $3,700,000 for Year 3, $3,600,000 for Year 4, $4,000,000 for Years 5 and 6, $3,200,000 for Years 7 and $2,600,000 thereafter. Cost savings arising from a special partially recoverable tax incentive are estimated to be $100,000 for each year 1 through 5 at which time the special incentive ends. This special tax incentive is partially recovered by the government as it is by treated as taxable income Chowdown Inc. has a corporate tax rate of 23%, and its current cost of capital is 11%. A risk adjustment of 3% is considered appropriate. REQUIRED: (Show all work) a) Calculate the net present value of the manufacturing facility project. (15 marks) b) Should the project proceed - why? Is the IRR higher or lower? (2 marks) c) What is the undiscounted payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts