Question: Question 1 (20 marks) Consider a 6-month gold forward contract with a price of $1,780. The spot price of physical gold is currently trading at

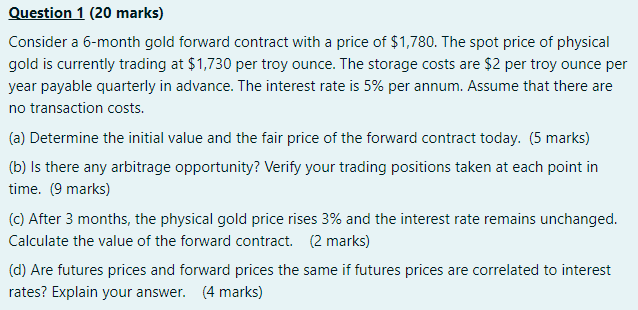

Question 1 (20 marks) Consider a 6-month gold forward contract with a price of $1,780. The spot price of physical gold is currently trading at $1,730 per troy ounce. The storage costs are $2 per troy ounce per year payable quarterly in advance. The interest rate is 5% per annum. Assume that there are no transaction costs. (a) Determine the initial value and the fair price of the forward contract today. (5 marks) (b) Is there any arbitrage opportunity? Verify your trading positions taken at each point in time. (9 marks) (c) After 3 months, the physical gold price rises 3% and the interest rate remains unchanged. Calculate the value of the forward contract. (2 marks) (d) Are futures prices and forward prices the same if futures prices are correlated to interest rates? Explain your answer. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts