Question: QUESTION 1 (20 marks for final paper + 2 marks for milestones) The GreatoreCo mining company wishes to determine whether it should proceed to develop

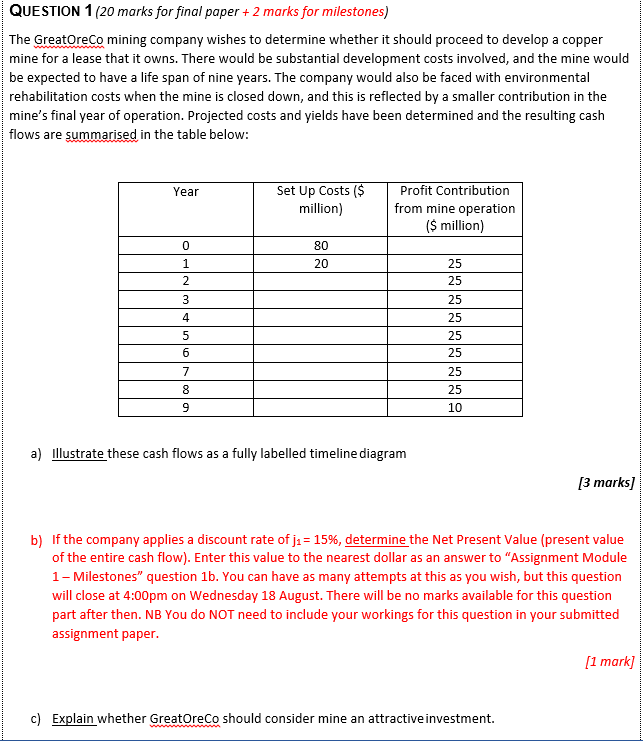

QUESTION 1 (20 marks for final paper + 2 marks for milestones) The GreatoreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be substantial development costs involved, and the mine would be expected to have a life span of nine years. The company would also be faced with environmental rehabilitation costs when the mine is closed down, and this is reflected by a smaller contribution in the mine's final year of operation. Projected costs and yields have been determined and the resulting cash flows are summarised in the table below: Year Set Up Costs ($ million) Profit Contribution from mine operation ($ million) 0 1 2 80 20 25 25 3 4 25 25 25 25 5 6 7 8 9 25 25 10 a) illustrate these cash flows as a fully labelled timeline diagram [3 marks) b) If the company applies a discount rate of j1 = 15%, determine the Net Present Value (present value of the entire cash flow). Enter this value to the nearest dollar as an answer to "Assignment Module 1- Milestones" question 1b. You can have as many attempts at this as you wish, but this question will close at 4:00pm on Wednesday 18 August. There will be no marks available for this question part after then. NB You do NOT need to include your workings for this question in your submitted assignment paper. [1 mark] c) Explain whether GreatoreCo should consider mine an attractive investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts