Question: Question 1 (20 marks) Part A. STAT Ltd has $20 million loan due at the end of the year and its assets will have a

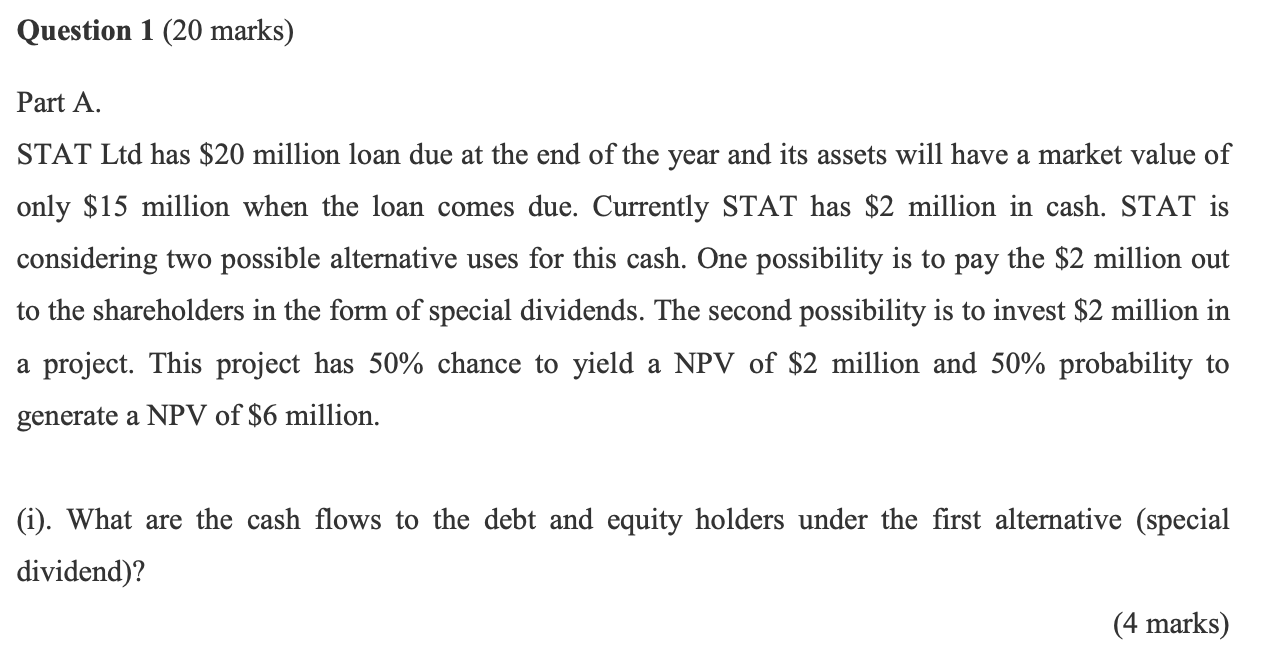

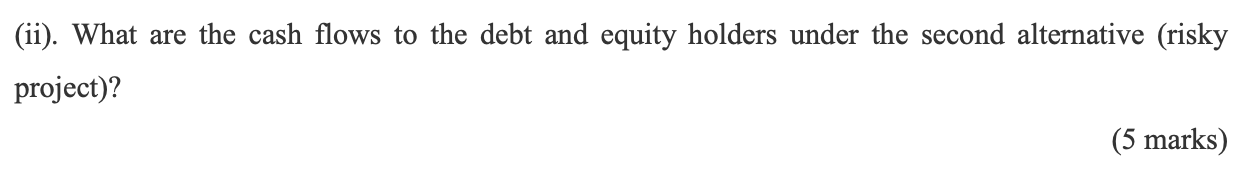

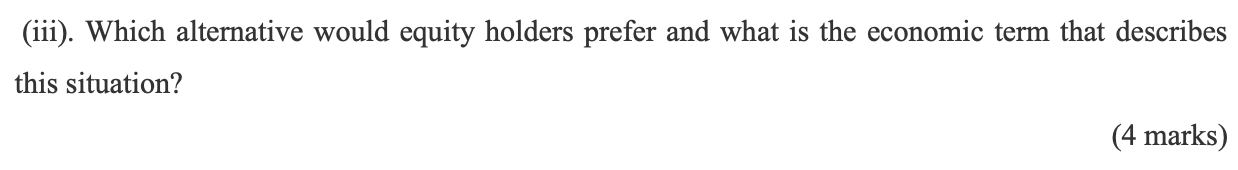

Question 1 (20 marks) Part A. STAT Ltd has $20 million loan due at the end of the year and its assets will have a market value of only $15 million when the loan comes due. Currently STAT has $2 million in cash. STAT is considering two possible alternative uses for this cash. One possibility is to pay the $2 million out to the shareholders in the form of special dividends. The second possibility is to invest $2 million in a project. This project has 50% chance to yield a NPV of $2 million and 50% probability to generate a NPV of $6 million. (i). What are the cash flows to the debt and equity holders under the first alternative (special dividend)? (4 marks) (ii). What are the cash flows to the debt and equity holders under the second alternative (risky project)? (5 marks) (iii). Which alternative would equity holders prefer and what is the economic term that describes this situation? (4 marks) Question 1 (20 marks) Part A. STAT Ltd has $20 million loan due at the end of the year and its assets will have a market value of only $15 million when the loan comes due. Currently STAT has $2 million in cash. STAT is considering two possible alternative uses for this cash. One possibility is to pay the $2 million out to the shareholders in the form of special dividends. The second possibility is to invest $2 million in a project. This project has 50% chance to yield a NPV of $2 million and 50% probability to generate a NPV of $6 million. (i). What are the cash flows to the debt and equity holders under the first alternative (special dividend)? (4 marks) (ii). What are the cash flows to the debt and equity holders under the second alternative (risky project)? (5 marks) (iii). Which alternative would equity holders prefer and what is the economic term that describes this situation? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts