Question: QUESTION 1 (20 Marks) REQUIRED Use the information provided below to prepare the Cash Flow Statement of Fairmont Limited for the year ended 31 December

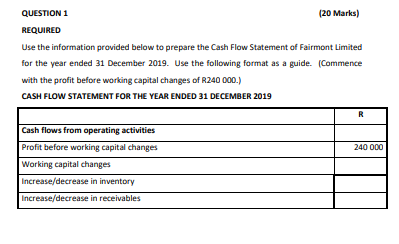

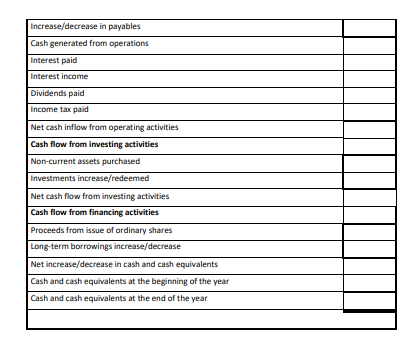

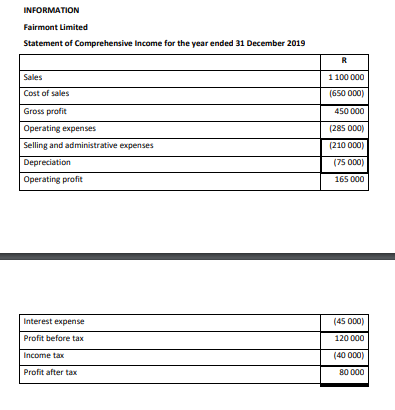

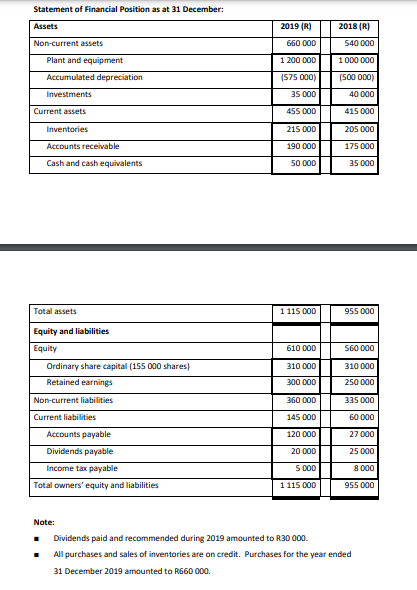

QUESTION 1 (20 Marks) REQUIRED Use the information provided below to prepare the Cash Flow Statement of Fairmont Limited for the year ended 31 December 2019. Use the following format as a guide. (Commence with the profit before working capital changes of R240 000.) CASH FLOW STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2019 R Cash flows from operating activities Profit before working capital changes 240 000 Working capital changes increase/decrease in inventory Increase/decrease in receivables Increase/decrease in payables Cash generated from operations Interest paid Interest income Dividends paid income tax paid Net cash inflow from operating activities Cash flow from investing activities Non-current assets purchased Investments increase/redeemed Net cash flow from investing activities Cash flow from financing activities Proceeds from issue of ordinary shares Long-term borrowings increase/decrease Net increase/decrease in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at the end of the year INFORMATION Fairmont Limited Statement of Comprehensive Income for the year ended 31 December 2019 R 1 100 000 Sales Cost of sales (650 000) 450 000 Gross profit Operating expenses Selling and administrative expenses Depreciation Operating profit (285 000) (210 000) (75 000) 165 000 Interest expense Profit before tax Income tax Profit after tax (45000) 120 000 (40000) 80 000 Statement of Financial Position as at 31 December: Assets 2019 (R) 2018 (R) Non-current assets 660 000 540000 1 000 000 Plant and equipment Accumulated depreciation 1 200 000 (575 000) (500 000) 40 000 Investments 35 000 Current assets 455 000 415 000 215 000 205 000 Inventories Accounts receivable Cash and cash equivalents 190 000 175 000 SO 000 35 000 Total assets 1 115 000 955 000 Equity and liabilities 610 000 560 000 Equity Ordinary share capital (155 000 shares) Retained earnings 310 000 310 000 250 000 300 000 Non-current liabilities 360 000 335 000 Current liabilities 145 000 60 000 120 000 27 000 20 000 25 000 Accounts payable Dividends payable Income tax payable Total owners' equity and liabilities 5 000 8 000 1 115 000 955 000 Note: Dividends paid and recommended during 2019 amounted to R30 000 All purchases and sales of inventories are on credit. Purchases for the year ended 31 December 2019 amounted to R660 000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts