Question: Question 1 (20 marks) Suppose a trader purchases a bond between coupon periods. The days between the settlement date and the next coupon period is

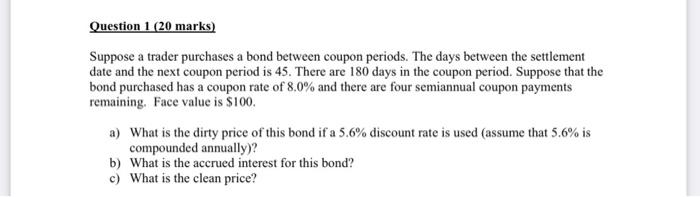

Question 1 (20 marks) Suppose a trader purchases a bond between coupon periods. The days between the settlement date and the next coupon period is 45. There are 180 days in the coupon period. Suppose that the bond purchased has a coupon rate of 8.0% and there are four semiannual coupon payments remaining. Face value is $100. a) What is the dirty price of this bond if a 5.6% discount rate is used (assume that 5.6% is compounded annually)? b) What is the accrued interest for this bond? c) What is the clean price

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock