Question: Question 1 (20 marks) The term structure is flat in Hong Kong dollar (HKD) while it is increasing with growth rate 5% per year in

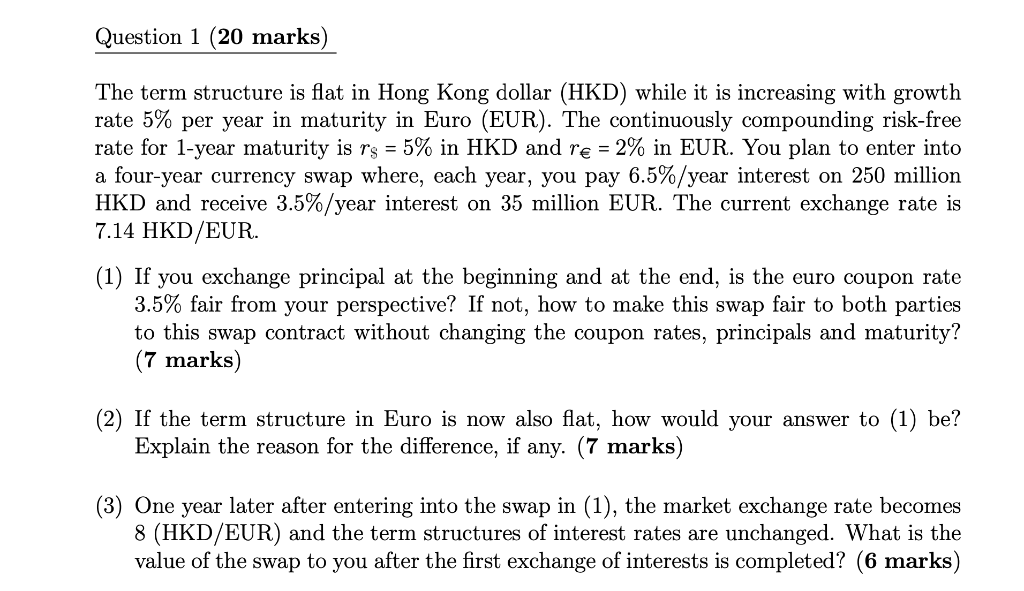

Question 1 (20 marks) The term structure is flat in Hong Kong dollar (HKD) while it is increasing with growth rate 5% per year in maturity in Euro (EUR). The continuously compounding risk-free rate for 1-year maturity is rs = 5% in HKD and re = 2% in EUR. You plan to enter into a four-year currency swap where, each year, you pay 6.5%/year interest on 250 million HKD and receive 3.5%/year interest on 35 million EUR. The current exchange rate is 7.14 HKD/EUR. (1) If you exchange principal at the beginning and at the end, is the euro coupon rate 3.5% fair from your perspective? If not, how to make this swap fair to both parties to this swap contract without changing the coupon rates, principals and maturity? (7 marks) (2) If the term structure in Euro is now also flat, how would your answer to (1) be? Explain the reason for the difference, if any. (7 marks) (3) One year later after entering into the swap in (1), the market exchange rate becomes 8 (HKD/EUR) and the term structures of interest rates are unchanged. What is the value of the swap to you after the first exchange of interests is completed? (6 marks) Question 1 (20 marks) The term structure is flat in Hong Kong dollar (HKD) while it is increasing with growth rate 5% per year in maturity in Euro (EUR). The continuously compounding risk-free rate for 1-year maturity is rs = 5% in HKD and re = 2% in EUR. You plan to enter into a four-year currency swap where, each year, you pay 6.5%/year interest on 250 million HKD and receive 3.5%/year interest on 35 million EUR. The current exchange rate is 7.14 HKD/EUR. (1) If you exchange principal at the beginning and at the end, is the euro coupon rate 3.5% fair from your perspective? If not, how to make this swap fair to both parties to this swap contract without changing the coupon rates, principals and maturity? (7 marks) (2) If the term structure in Euro is now also flat, how would your answer to (1) be? Explain the reason for the difference, if any. (7 marks) (3) One year later after entering into the swap in (1), the market exchange rate becomes 8 (HKD/EUR) and the term structures of interest rates are unchanged. What is the value of the swap to you after the first exchange of interests is completed? (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts