Question: Question 1 (20 marks) This question relates to material covered in the Topics 1 to 3. This question addresses the 5th and 6th subject learning

Question 1 (20 marks)

This question relates to material covered in the Topics 1 to 3. This question addresses the 5th and 6th subject learning outcomes.

For the following numerical problems, detailed answers must be shown. This involves providing a brief description of the problems, formulae used, progressive and final answers to the questions. For assignments you are expected to show your workings using the appropriate formula.

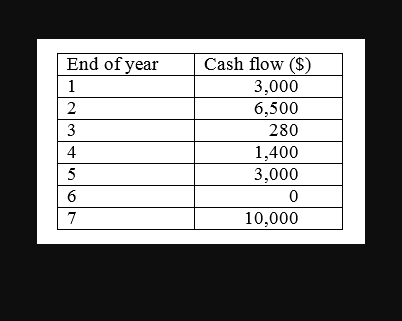

(a) Scotty Thomson expects to receive the following stream of cash flows from an investment over the next 7 years:

If Scottys required rate of return is 6% per annum on this investment, how much should he pay for this investment opportunity? (4 marks)

(b) Jarrad Waite has purchased a new apartment in North Melbourne for $1.8 million. He plans to finance the whole amount with a loan from the community bank Kanga Kash. Jarrad has been offered a 30 year term loan with monthly repayments at a nominal rate of 5% per annum.

Given Jarrad is financing the whole purchase amount with debt, what will be his monthly repayment amount? (4 marks)

(c) Ben Cunnington is planning for his retirement and has $50,000 to invest as a lump sum into a retirement investment plan. Ben plans to work for another 35 years before retiring at the age of 65 and, as well as the $50,000 lump sum, he plans to deposit $1,500 into a capital secured share index fund each month of his remaining working life. He estimates that his retirement account will generate an annual return of 7%. Ben plans to retire at 65 and then draw a pension from his savings for a further twenty five years. During this retirement phase Ben expects to be investing conservatively and estimates a 5% per annum return. At the age of 90, at the completion of the pension, Ben would like to have $200,000 remaining in the account for contingencies.

(i) Calculate the Future Value of the monthly saving deposits and the lump sum deposited today based on monthly compounding and a rate of 7% per annum (4 marks).

(ii) Calculate the annual pension that Ben will receive after retirement, taking into account the requirement to have $200,000 remaining at the end of the pension period. Ben plans to receive his first retirement pension payment annually with the first payment occurring one year after he retires (8 marks).

End of year Cash flow (S) 3,000 6,500 280 1,400 3,000 0 10,000 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts