Question: Question 1 (20 points) 1. Consider call and put options expiring in 42 days, in which the underlying is at 72 and the risk-free rate

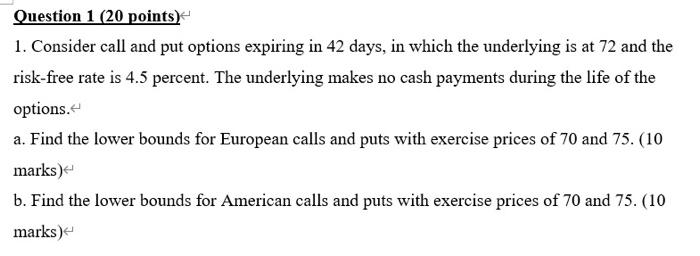

Question 1 (20 points) 1. Consider call and put options expiring in 42 days, in which the underlying is at 72 and the risk-free rate is 4.5 percent. The underlying makes no cash payments during the life of the options. a. Find the lower bounds for European calls and puts with exercise prices of 70 and 75. (10 marks) b. Find the lower bounds for American calls and puts with exercise prices of 70 and 75. (10 marks) Question 1 (20 points) 1. Consider call and put options expiring in 42 days, in which the underlying is at 72 and the risk-free rate is 4.5 percent. The underlying makes no cash payments during the life of the options. a. Find the lower bounds for European calls and puts with exercise prices of 70 and 75. (10 marks) b. Find the lower bounds for American calls and puts with exercise prices of 70 and 75. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts