Question: Question 1: (20 Points) Abbey Drinks Inc. is considering introducing a new product with an estimated life of five years. The project requires an initial

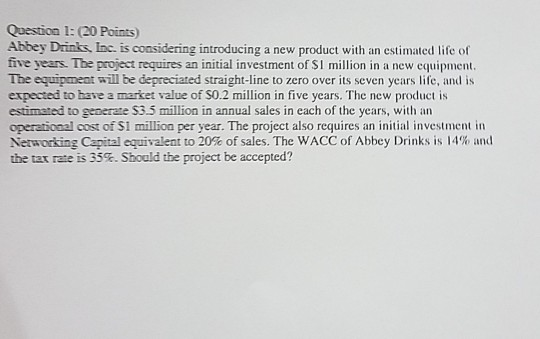

Question 1: (20 Points) Abbey Drinks Inc. is considering introducing a new product with an estimated life of five years. The project requires an initial investment of $1 million in a new equipment. The equipmeat will be depreciated straight-line to zero over its seven years life, and is expected to have a market value of S0.2 million in five years. The new product is estimated to generate S3.5 million in annual sales in each of the years, with an operational cost of S1 million per year. The project also requires an initial investment in Networking Capital equivalent to 20% of sales. The WACC of Abbey Drinks is 14%, and the tax rate is 35%. Should the project be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts