Question: Question 1 (20 points) - Chapters 4 & 5 Home is a small open economy with perfect (financial) capital mobility. Initially, it is in its

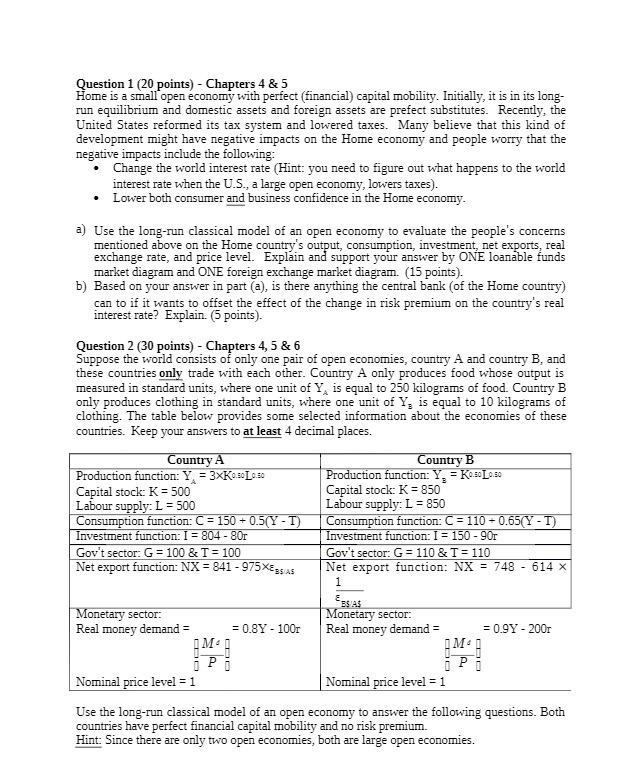

Question 1 (20 points) - Chapters 4 & 5 Home is a small open economy with perfect (financial) capital mobility. Initially, it is in its long- run equilibrium and domestic assets and foreign assets are prefect substitutes. Recently, the United States reformed its tax system and lowered taxes. Many believe that this kind of development might have negative impacts on the Home economy and people worry that the negative impacts include the following . Change the world interest rate (Hint: you need to figure out what happens to the world interest rate when the U.5., a large open economy, lowers taxes). Lower both consumer and business confidence in the Home economy. A) Use the long-run classical model of an open economy to evaluate the people's concerns mentioned above on the Home country's output, consumption, investment, net exports, real exchange rate, and price level. Explain and support your answer by ONE loanable funds market diagram and ONE foreign exchange market diagram. (15 points). b) Based on your answer in part (a), is there anything the central bank (of the Home country) can to if it wants to offset the effect of the change in risk premium on the country's real interest rate? Explain. (5 points). Question 2 (30 points) - Chapters 4, 5 & 6 Suppose the world consists of only one pair of open economies, country A and country B, and these countries only trade with each other. Country A only produces food whose output is measured in standard units, where one unit of Y, is equal to 250 kilograms of food. Country B only produces clothing in standard units, where one unit of Y, is equal to 10 kilograms of clothing. The table below provides some selected information about the economies of these countries. Keep your answers to at least 4 decimal places. Country A Country B Production function: Y = 3xKo.30 Lo.50 Production function: Y, = Ko.= Lo.so Capital stock: K = 500 Capital stock: K = 850 Labour supply: L = 500 Labour supply: L = 850 Consumption function: C = 150 + 0.5(Y - T) Consumption function: C = 110 + 0.65(Y - T) Investment function: I = 804 - 80r Investment function: I = 150 - 90r Gov't sector: G = 100 & T = 100 Gov't sector: G = 110 & T = 110 Net export function: NX = 841 - 975 XESSAE Net export function: NX = 748 - 614 x Monetary sector: Monetary sector: Real money demand = =0.8Y - 100r Real money demand = = 0.9Y - 200r i Pi - Pi Nominal price level = 1 Nominal price level = 1 Use the long-run classical model of an open economy to answer the following questions. Both countries have perfect financial capital mobility and no risk premium. Hint: Since there are only two open economies, both are large open economies