Question: Question 1 (20 points) PROBLEM #1 (Recommended Time Allocation: 40 Minutes; 20 Marks) Lekan Corp provided you with the following information about its investment in

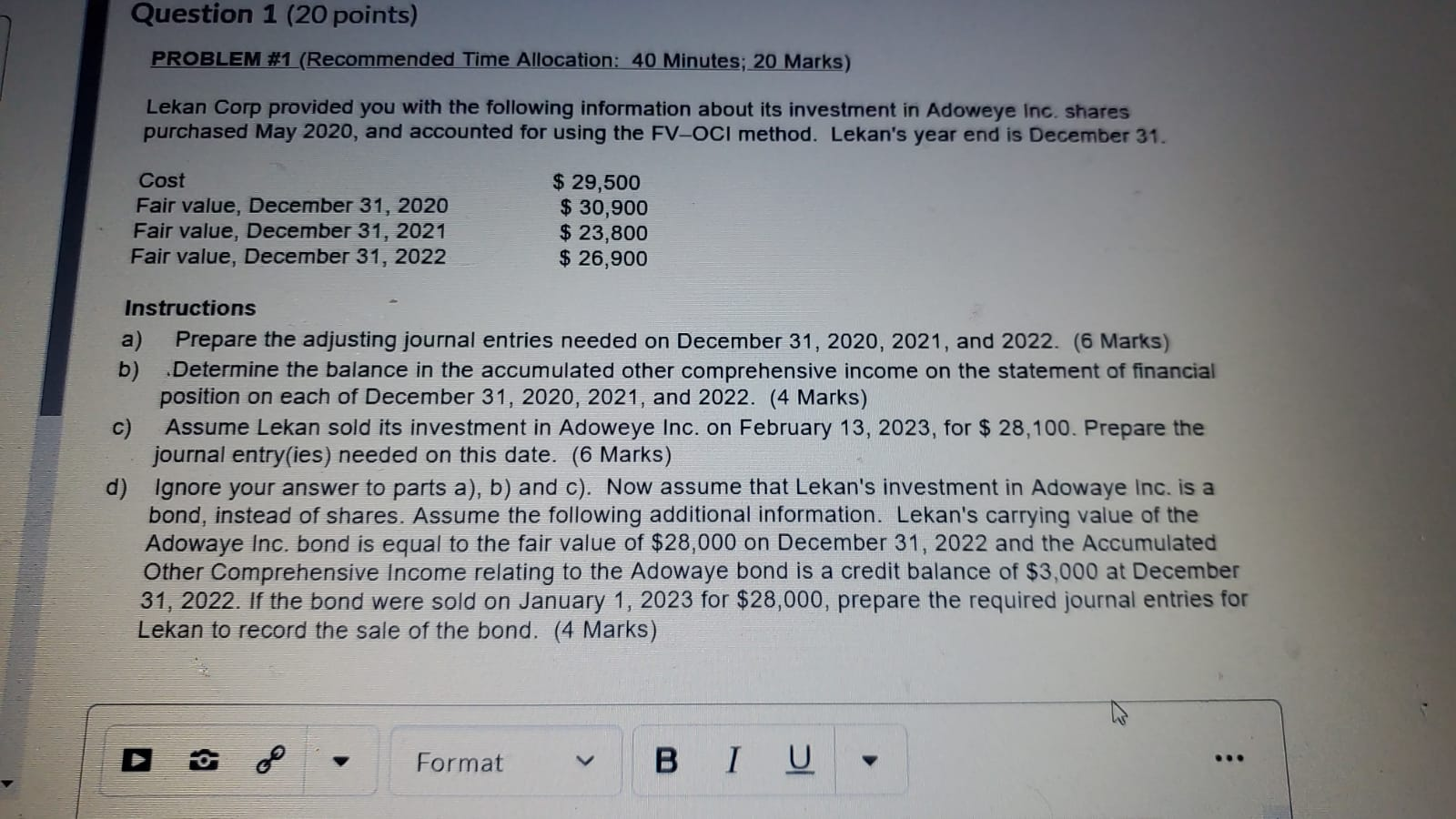

Question 1 (20 points) PROBLEM #1 (Recommended Time Allocation: 40 Minutes; 20 Marks) Lekan Corp provided you with the following information about its investment in Adoweye Inc. shares purchased May 2020, and accounted for using the FV-OCI method. Lekan's year end is December 31. Cost Fair value, December 31, 2020 Fair value, December 31, 2021 Fair value, December 31, 2022 $ 29,500 $ 30,900 $ 23,800 $ 26,900 Instructions a) Prepare the adjusting journal entries needed on December 31, 2020, 2021, and 2022. (6 Marks) b) Determine the balance in the accumulated other comprehensive income on the statement of financial position on each of December 31, 2020, 2021, and 2022. (4 Marks) c) Assume Lekan sold its investment in Adoweye Inc. on February 13, 2023, for $ 28,100. Prepare the journal entry(ies) needed on this date. (6 Marks) d) Ignore your answer to parts a), b) and c). Now assume that Lekan's investment in Adowaye Inc. is a bond, instead of shares. Assume the following additional information. Lekan's carrying value of the Adowaye Inc. bond is equal to the fair value of $28,000 on December 31, 2022 and the Accumulated Other Comprehensive Income relating to the Adowaye bond is a credit balance of $3,000 at December 31, 2022. If the bond were sold on January 1, 2023 for $28,000, prepare the required journal entries for Lekan to record the sale of the bond. (4 Marks) o Format B I U

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts