Question: Question 1 (20 points) Use the Excel worksheet from the Assignments folder to answer all questions in this exam. Since going public recently, Spotify has

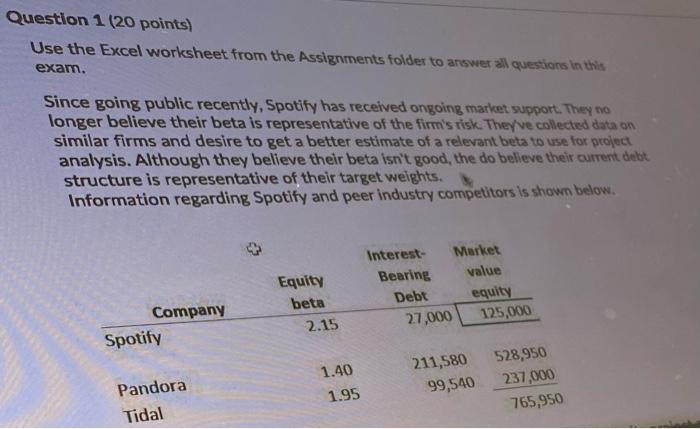

Question 1 (20 points) Use the Excel worksheet from the Assignments folder to answer all questions in this exam. Since going public recently, Spotify has received ongoing market support. They no longer believe their beta is representative of the firm's risk. They've collected data on similar firms and desire to get a better estimate of a relevant beta to use for project analysis. Although they believe their beta isn't good, the do believe their cutrem debt structure is representative of their target weights. Information regarding Spotify and peer industry competitors is shown below. Equity beta Interest- Market Bearing value Debt equity 27,000 125,000 Company Spotify 2.15 211,580 99,540 1.40 1.95 528,950 237,000 765,950 Pandora Tidal #1..What is your estimate of the beta that Spotify should use in its project analis The company believes a market value weighting is the best approach for weighting beta. #2...If market conditions are such that the treasury bond rate is 3.5% and the market risk premium is 5.5%, what is the required return that Spotity should use in project analysis, given your answer above? . Show your work in the associated worksheet in the Excel template. NOTE: Ignore the 'Options indicator for question answers. Place your solutions in the provided areas here and on your worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts