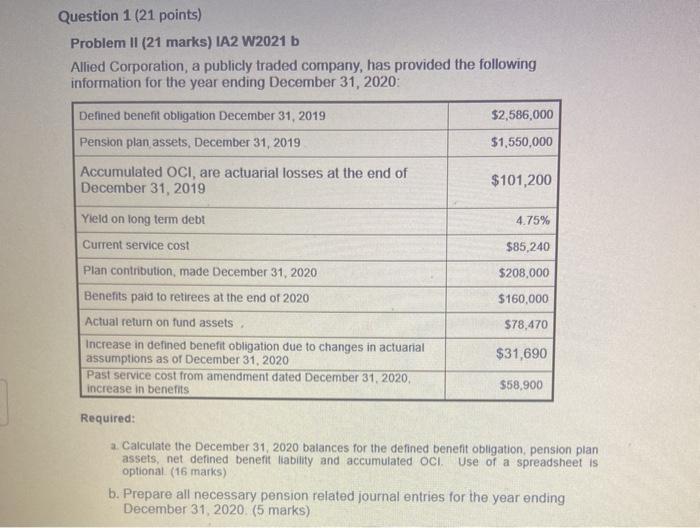

Question: Question 1 (21 points) Problem II (21 marks) IA2 W2021 b Allied Corporation, a publicly traded company, has provided the following information for the year

Question 1 (21 points) Problem II (21 marks) IA2 W2021 b Allied Corporation, a publicly traded company, has provided the following information for the year ending December 31, 2020: $2,586,000 Defined benefit obligation December 31, 2019 Pension plan assets, December 31, 2019 $1,550,000 Accumulated OCI, are actuarial losses at the end of December 31, 2019 $101,200 Yield on long term debt 4.75% Current service cost $85,240 $208,000 $160,000 Plan contribution, made December 31, 2020 Benefits paid to retirees at the end of 2020 Actual return on fund assets Increase in defined benefit obligation due to changes in actuarial assumptions as of December 31, 2020 Past service cost from amendment dated December 31, 2020 increase in benefits $78,470 $31,690 $58.900 Required: a. Calculate the December 31, 2020 balances for the defined benefit obligation, pension plan assets, net defined benefit liability and accumulated OCI. Use of a spreadsheet is optional (16 marks) b. Prepare all necessary pension related journal entries for the year ending December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts