Question: QUESTION 1 (25 Marks) 1.1 You want to begin saving for your daughter's college education and you estimate that she will need R200 000 in

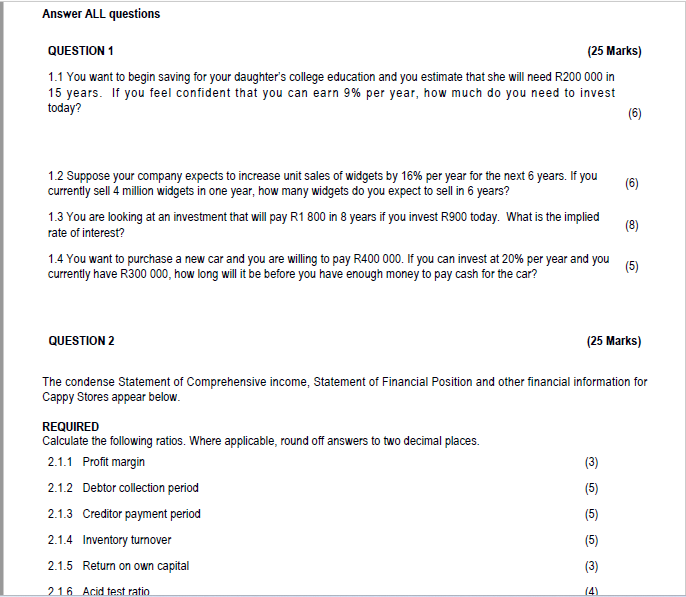

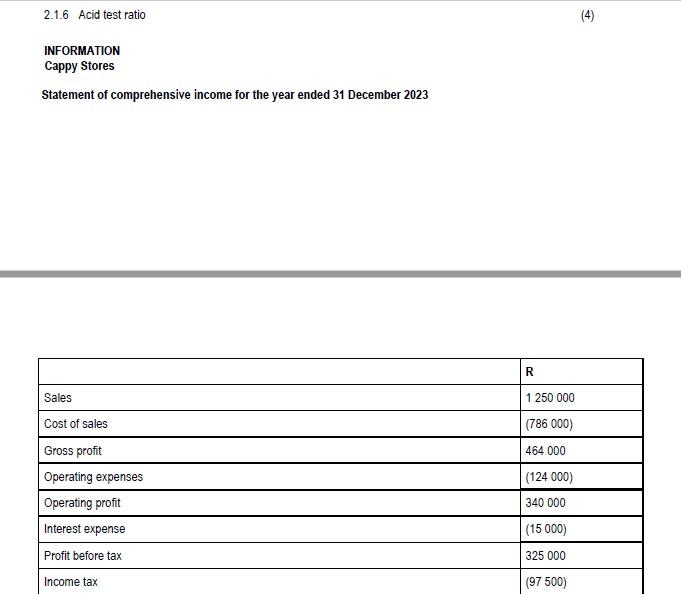

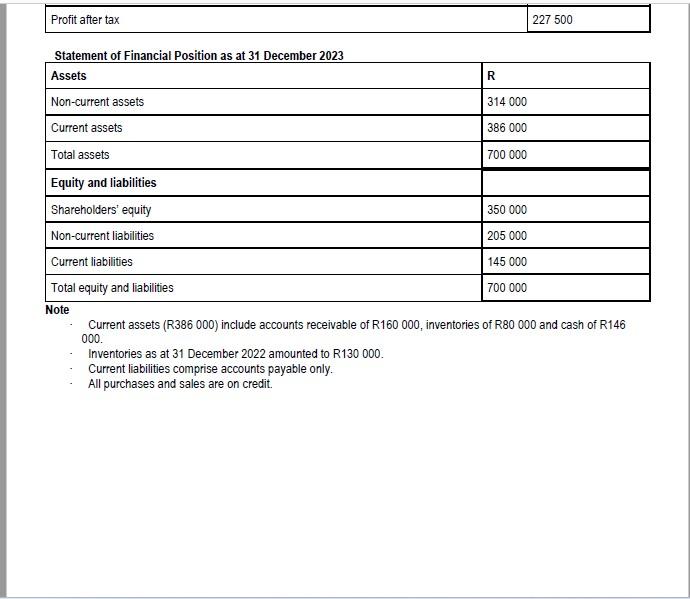

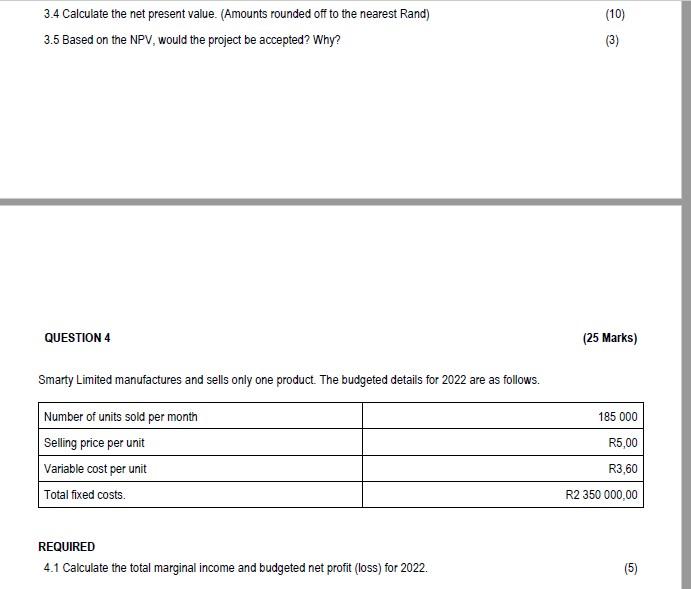

QUESTION 1 (25 Marks) 1.1 You want to begin saving for your daughter's college education and you estimate that she will need R200 000 in 15 years. If you feel confident that you can earn 9% per year, how much do you need to invest today? 1.2 Suppose your company expects to increase unit sales of widgets by 16% per year for the next 6 years. If you currently sell 4 million widgets in one year, how many widgets do you expect to sell in 6 years? 1.3 You are looking at an investment that will pay R1 800 in 8 years if you invest R900 today. What is the implied rate of interest? 1.4 You want to purchase a new car and you are willing to pay R400 000. If you can invest at 20% per year and you currently have R300 000, how long will it be before you have enough money to pay cash for the car? QUESTION 2 (25 Marks) The condense Statement of Comprehensive income, Statement of Financial Position and other financial information for Cappy Stores appear below. REQUIRED Calculate the following ratios. Where applicable, round off answers to two decimal places. 2.1.1 Profit margin 2.1.2 Debtor collection period 2.1.3 Creditor payment period 2.1.4 Inventory turnover 2.1.5 Return on own capital 216 Acid test ratio (4) 2.1.6 Acid test ratio INFORMATION Cappy Stores Statement of comprehensive income for the year ended 31 December 2023 Current assets ( R386000 ) include accounts receivable of R160000, inventories of R80000 and cash of R146 000. - Inventories as at 31 December 2022 amounted to R130 000. Current liabilities comprise accounts payable only. All purchases and sales are on credit. 3.4 Calculate the net present value. (Amounts rounded off to the nearest Rand) 3.5 Based on the NPV, would the project be accepted? Why? QUESTION 4 (25 Marks) Smarty Limited manufactures and sells only one product. The budgeted details for 2022 are as follows. REQUIRED 4.1 Calculate the total marginal income and budgeted net profit (loss) for 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts