Question: Question 1 (25 Marks) a) The Arbitrage Pricing Theory (APT) originally coined by Stephen Ross, is an important asset pricing model used in a variety

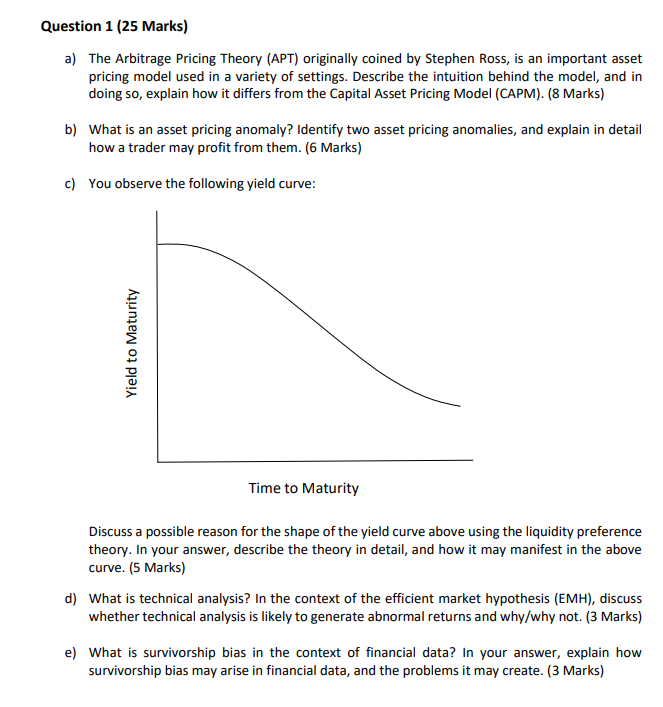

Question 1 (25 Marks) a) The Arbitrage Pricing Theory (APT) originally coined by Stephen Ross, is an important asset pricing model used in a variety of settings. Describe the intuition behind the model, and in doing so, explain how it differs from the Capital Asset Pricing Model (CAPM). (8 Marks) b) What is an asset pricing anomaly? Identify two asset pricing anomalies, and explain in detail how a trader may profit from them. (6 Marks) c) You observe the following yield curve: Yield to Maturity Time to Maturity Discuss a possible reason for the shape of the yield curve above using the liquidity preference theory. In your answer, describe the theory in detail, and how it may manifest in the above curve. (5 Marks) d) What is technical analysis? In the context of the efficient market hypothesis (EMH), discuss whether technical analysis is likely to generate abnormal returns and why/why not. (3 Marks) e) What is survivorship bias in the context of financial data? In your answer, explain how survivorship bias may arise in financial data, and the problems it may create. (3 Marks) Question 1 (25 Marks) a) The Arbitrage Pricing Theory (APT) originally coined by Stephen Ross, is an important asset pricing model used in a variety of settings. Describe the intuition behind the model, and in doing so, explain how it differs from the Capital Asset Pricing Model (CAPM). (8 Marks) b) What is an asset pricing anomaly? Identify two asset pricing anomalies, and explain in detail how a trader may profit from them. (6 Marks) c) You observe the following yield curve: Yield to Maturity Time to Maturity Discuss a possible reason for the shape of the yield curve above using the liquidity preference theory. In your answer, describe the theory in detail, and how it may manifest in the above curve. (5 Marks) d) What is technical analysis? In the context of the efficient market hypothesis (EMH), discuss whether technical analysis is likely to generate abnormal returns and why/why not. (3 Marks) e) What is survivorship bias in the context of financial data? In your answer, explain how survivorship bias may arise in financial data, and the problems it may create

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts