Question: QUESTION 1 (25 Marks) (a) Write a short note on: 1) Determinants of capital structure. 2) Hedging approach/Matching approach of working capital management. 3) Internal

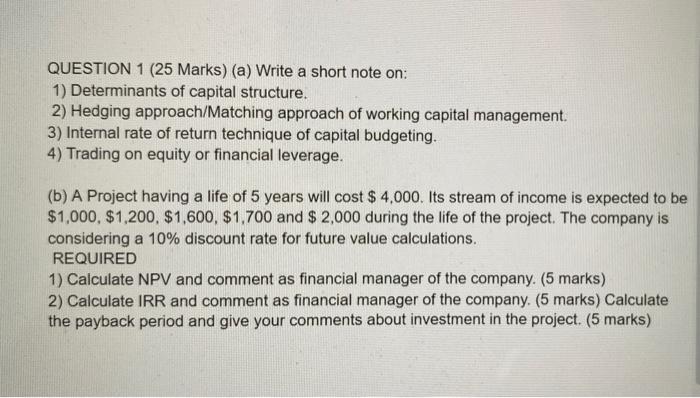

QUESTION 1 (25 Marks) (a) Write a short note on: 1) Determinants of capital structure. 2) Hedging approach/Matching approach of working capital management. 3) Internal rate of return technique of capital budgeting. 4) Trading on equity or financial leverage. (b) A Project having a life of 5 years will cost $ 4.000. Its stream of income is expected to be $1,000, $1,200, $1,600, $1,700 and $2,000 during the life of the project. The company is considering a 10% discount rate for future value calculations. REQUIRED 1) Calculate NPV and comment as financial manager of the company. (5 marks) 2) Calculate IRR and comment as financial manager of the company. (5 marks) Calculate the payback period and give your comments about investment in the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts