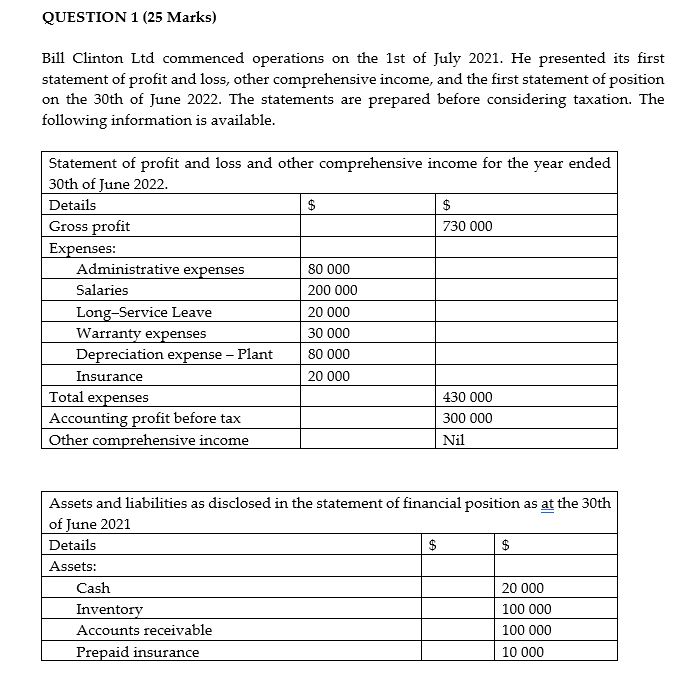

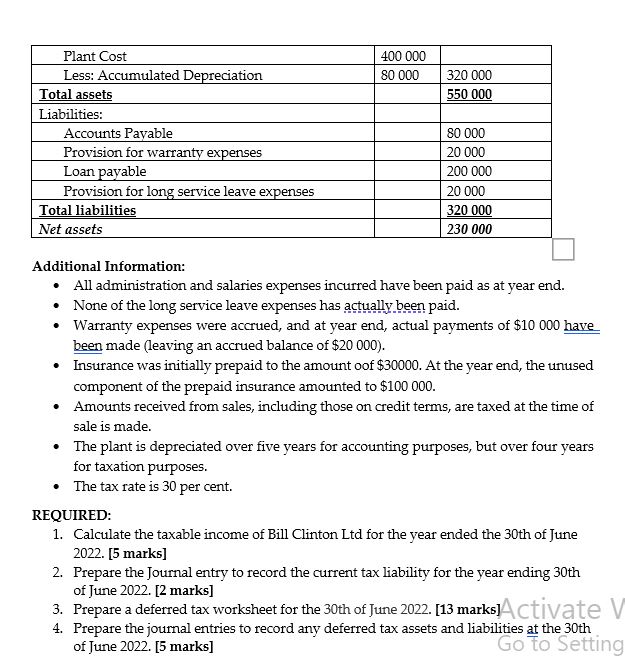

Question: QUESTION 1 (25 Marks} Bill Clinton Ltd commenced operations on the 1st of _Tul_-' 2021. He presented its first statement of profit and loss, other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts