Question: Eggs Ltd is considering purchasing a machine to pasteurize eggs to supplement their fresh eggs The company has already looked into the costs of

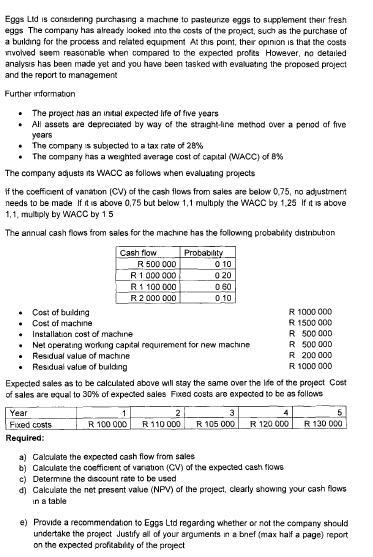

Eggs Ltd is considering purchasing a machine to pasteurize eggs to supplement their fresh eggs The company has already looked into the costs of the project, such as the purchase of a building for the process and related equipment At this point, their opinion is that the costs involved seem reasonable when compared to the expected profits However, no detailed. analysis has been made yet and you have been tasked with evaluating the proposed project and the report to management Further information The project has an initial expected life of five years All assets are depreciated by way of the straight-line method over a period of five years The company is subjected to a tax rate of 28% The company has a weighted average cost of capital (WACC) of 8% The company adjusts its WACC as follows when evaluating projects If the coefficient of vanation (CV) of the cash flows from sales are below 0,75, no adjustment needs to be made If it is above 0,75 but below 1.1 multiply the WACC by 1.25 If it is above 1,1, multiply by WACC by 15 The annual cash flows from sales for the machine has the following probability distribution . . Cost of building Cost of machine Cash flow Residual value of machine Residual value of building R 500 000 R 1 000 000 R1 100 000 R 2 000 000 Year Fixed costs Required: Installation cost of machine Net operating working capital requirement for new machine Probability 0 10 0 20 0 60 010 1 2 R 100 000 R 110 000 Expected sales as to be calculated above will stay the same over the life of the project Cost of sales are equal to 30% of expected sales Fixed costs are expected to be as follows R 1000 000 R 1500 000 R 500 000 R 500 000 R 200 000 R 1000 000 3 R 105 000 4 R 120 000 5 R 130 000 a) Calculate the expected cash flow from sales b) Calculate the coefficient of variation (CV) of the expected cash flows c) Determine the discount rate to be used d) Calculate the net present value (NPV) of the project, clearly showing your cash flows in a table e) Provide a recommendation to Eggs Ltd regarding whether or not the company should undertake the project Justify all of your arguments in a bnef (max half a page) reporti on the expected profitability of the project

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

a Expected cash flow from sales R500 000 x 01 R1 090 000 x 02 R1 100 000 x 06 R2 000 000 x 01 R1 400 ... View full answer

Get step-by-step solutions from verified subject matter experts